Send Inquiry

Jan 13, 2022

The Himalayas, one of the most beautiful yet fragile ecosystems in the world, is a source of water for billions of people living in South and Southeast Asia.

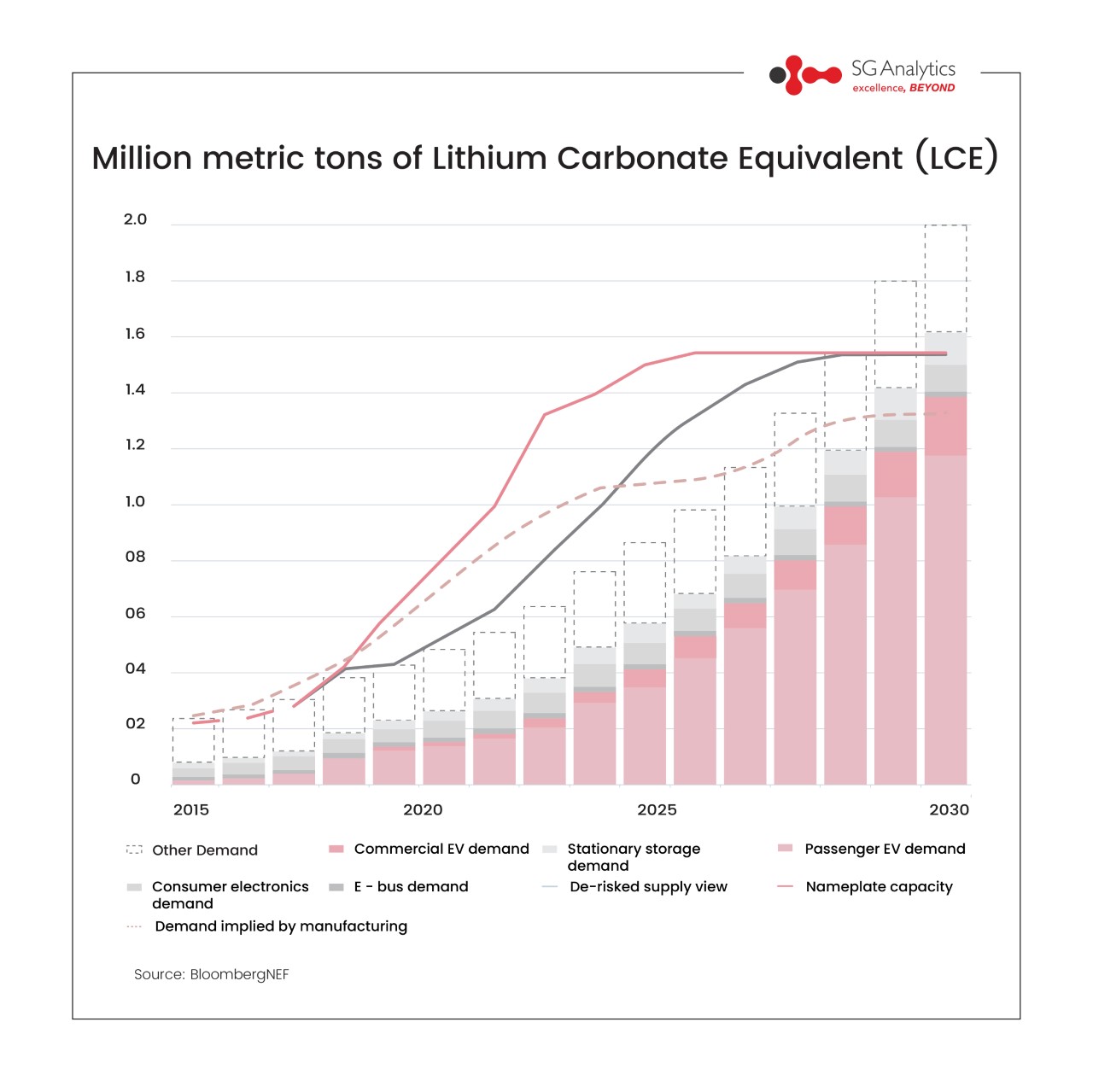

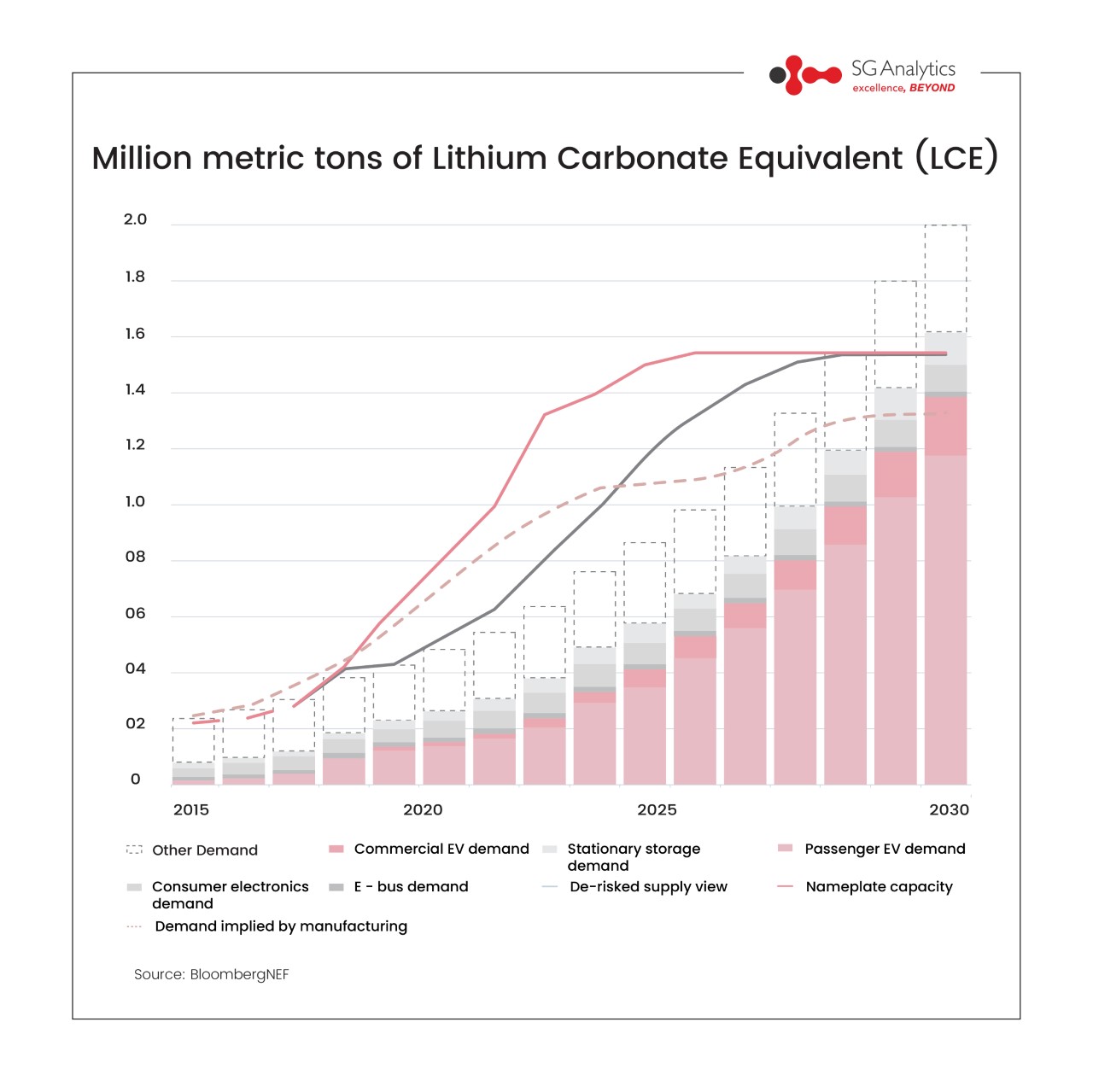

China is the largest refiner of the world’s lithium and currently the biggest investor in lithium mines around the globe. Chinese scientists recently discovered ‘super-large’ deposits of lithium near Mount Everest, that could potentially produce a million tons of lithium oxide, a key element in batteries powering electric vehicles.

While this discovery could provide raw material to accelerate the fast-growing Electric Vehicles (EV) and battery storage market, prospects of mining the newly found lithium deposits would be an energy- and water-intensive operation, leading to adverse environmental impacts, and raising severe concerns over the fate of freshwater resources in the Himalayas.

Jan 13, 2022

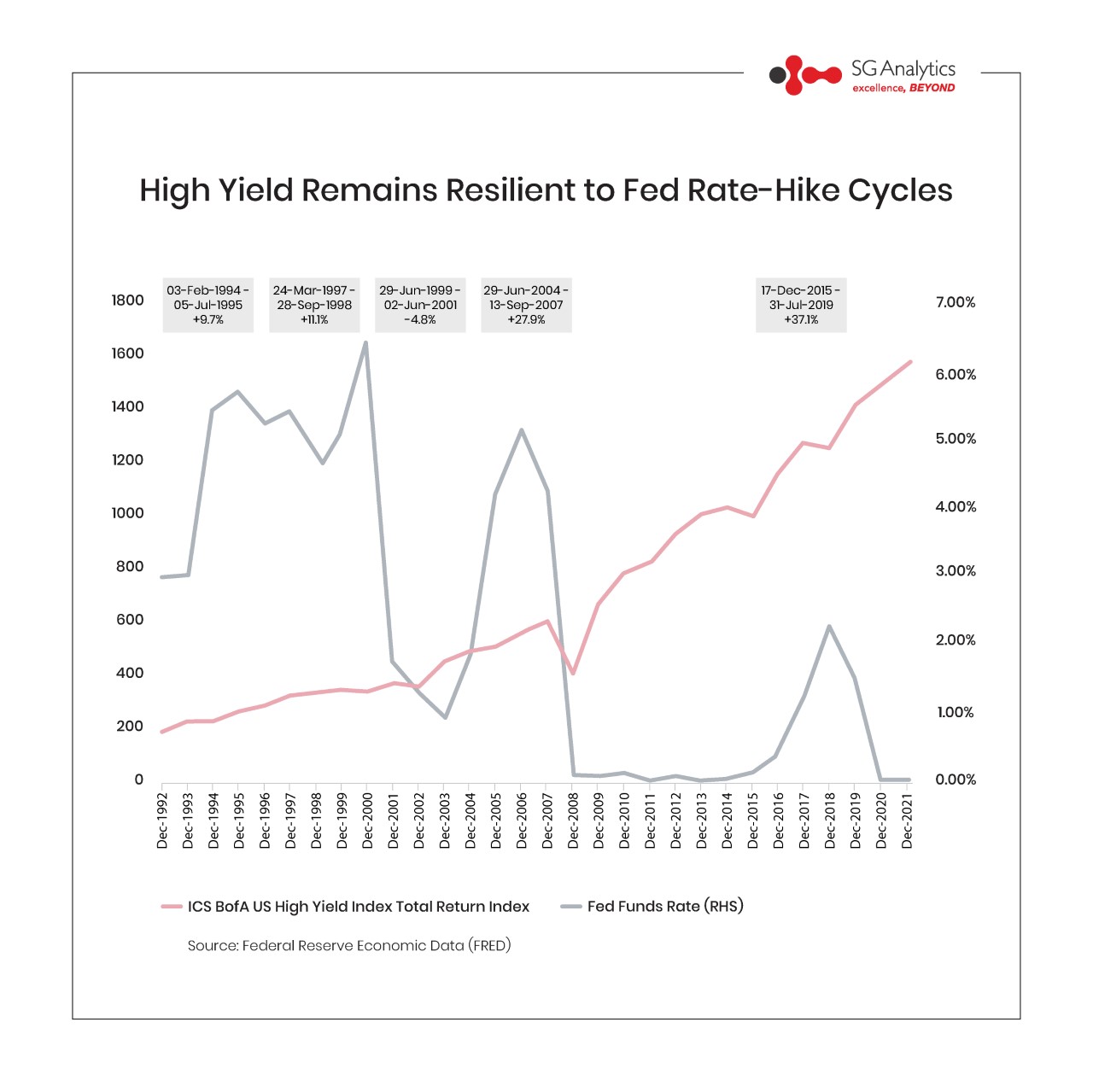

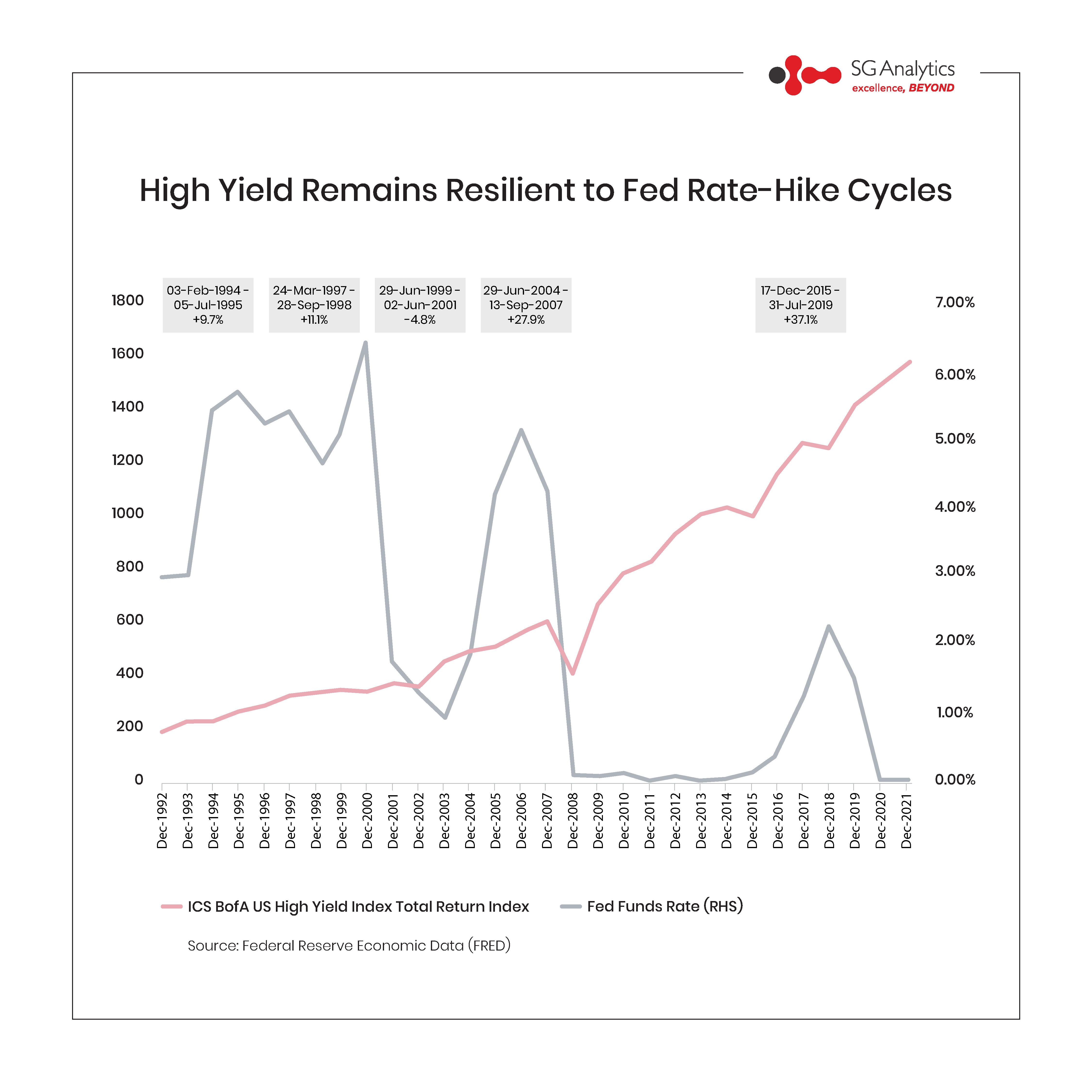

Following the Federal Reserve’s latest monetary policy meeting in January, the Fed is set to embark on its rate hike cycle with the first hike coming as soon as March to tame stubbornly high inflation. Concerns about an impending rate hike sparked volatility across assets classes, including US high-yield bonds. However, if history is a guide, US high yield performed well in the rising interest rate environment. The ICE BofA US high yield index outperformed with an average return of 16.2% during the Fed rate hike cycles since 1994 and delivered positive returns in 4 out of those 5 instances with the exception in 1999-2001, which coincided with the dot-com bubble burst.

That said, the economic background behind the rate hike cycle this time around looks different. The US inflation rate is nearly at a 40-year high of 7%, while the unemployment rate of 3.9% is just shy of the Fed's goal of maximum employment than the previous rate-hike cycles. These factors could cause the Fed to get even more aggressive. Moreover, the Fed has doubled the pace at which it is scaling back bond purchases, putting it on track to conclude the program by March 2022. It has also hinted at shrinking its balance sheet post hiking rates, with market participants expecting it to start in June 2022. Nevertheless, the corporate balance sheets had improved substantially in 2021 to weather the aftermath of monetary tightening.

Most of the companies are in the recovery or expansion phases of the credit cycle. Additionally, the high-yield index has near-zero exposure to the technology sector (highly sensitive to change in real interest rate) and short duration (around 5 years), making them stand pat against the rate hikes.

Jan 13, 2022

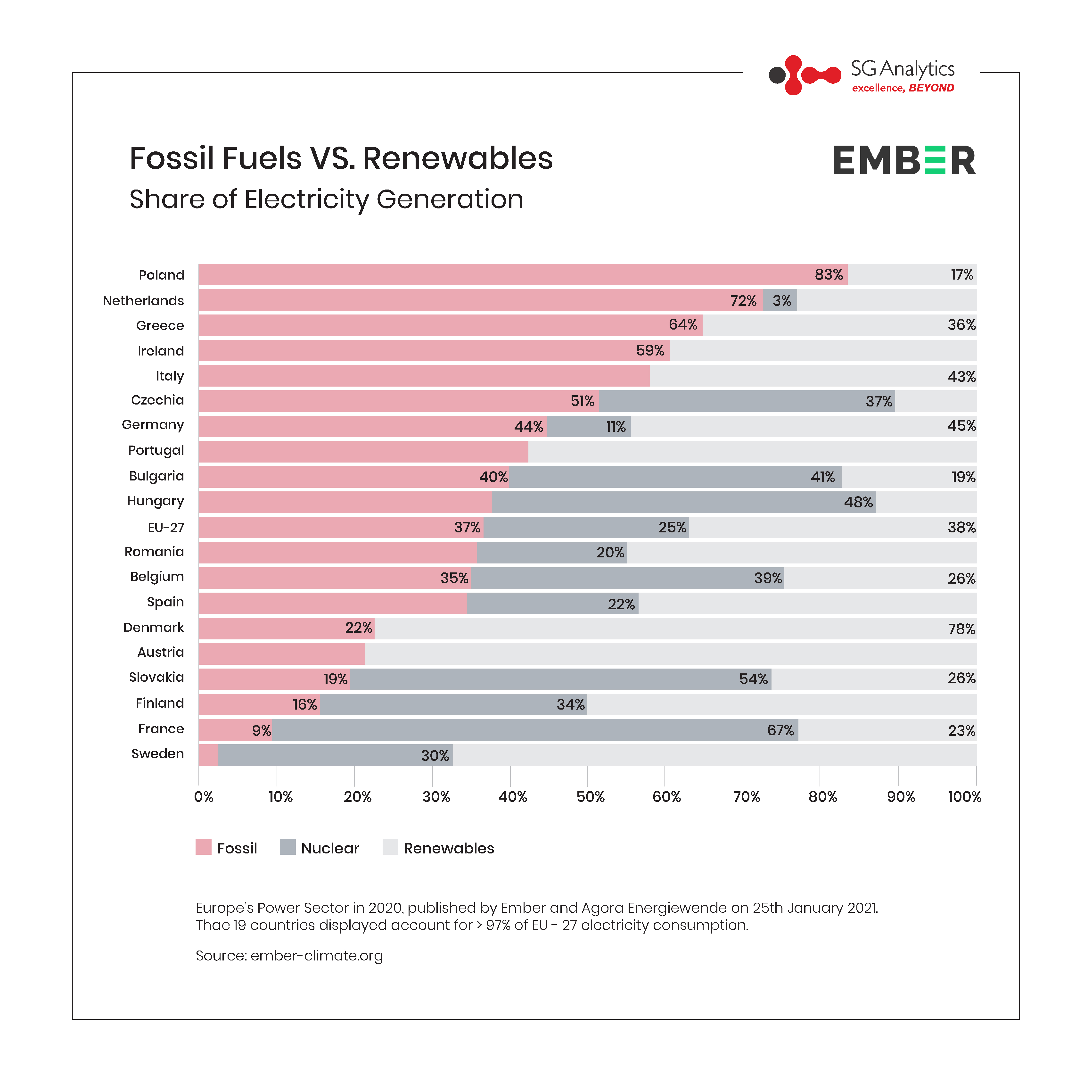

Last Wednesday, the European Commission proposed a highly divisive policy, calling for the energy derived from natural gas and nuclear to be labeled as “sustainable” investments if they meet certain criteria.

While admitting that the proposal was not perfect, EU Financial Services Commissioner, Mairead McGuinness, claimed it struck a balance between differing opinions.

The move has subjected the European Commission to criticism, with environmental groups and climate activists accusing the EU of “greenwashing." They claim that labeling natural gas and nuclear as green energy would slow down the adoption of renewable energy.

But proponents supporting the move counter that such incentives would aid underdeveloped countries to transition from coal to cleaner alternatives.

The decision, however, is not final. The European Parliament and council of heads have four months to consider the proposal.

Could the move hurt The Union's credibility? Was the proposal well-thought-out for an entity as influential as the EU, a beacon of climate action? Could it really accelerate the world's transition to a low-carbon future?

What do you think?

Jan 13, 2022

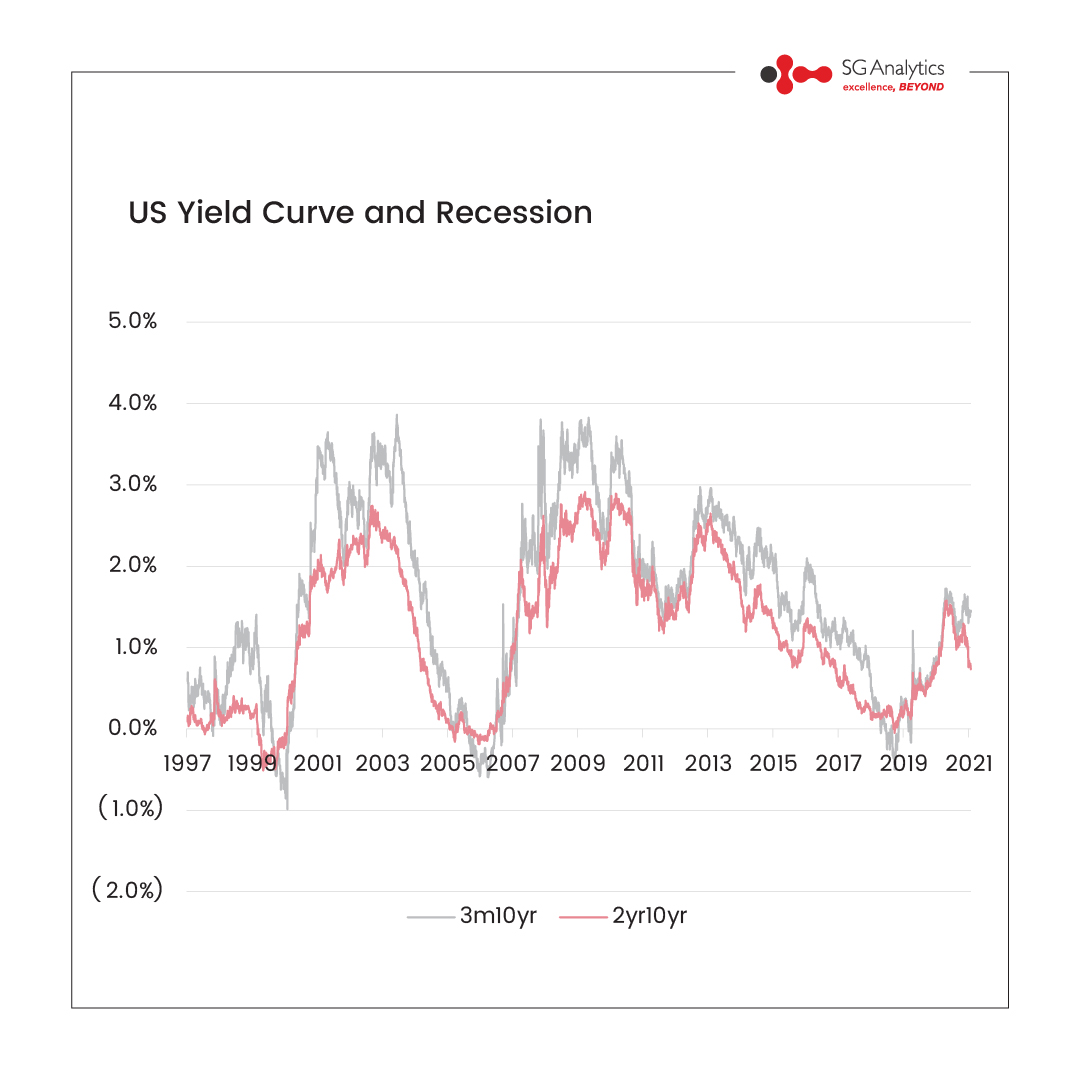

The US treasury yield curve is once again hogging the limelight as we enter the new year 2022. Of course, it makes complete sense to watch out for the curve, given its reliability in predicting recessions since the 1950s. Investors widely track the difference between the 3-month and 10-year yield (3m10s) as well as the 2-year and 10-year (2s10s) yield, also called the “spread.” Of late, the yield curve has been flattening, yet far away from getting inversion. Though, the flattening curve itself is a sign of something ominous awaiting the economy, perhaps sluggish growth but no recession. The US economic fundamentals remain strong, though inflated. Yes, it is unfortunate as even the Fed could not properly dissect inflation. The Fed initially views it as transitory, one of the worst inflation calls in its history. As it becomes clear that inflation is here to stay for long, the Fed adopts an aggressive monetary policy, causing the yield curve to flatten with short-term treasuries reacting more to the policy shift. Last time, the yield curve inversion sustained for over a quarter beginning May 2019, stoking fears that the longest economic expansion since the great recession could end soon. Surprisingly, it took an unexpected pandemic rather than the economic fundamentals to bring the economy to its knees, helping preserve the reliability of the yield curve in predicting a recession. The US economy seems to be on a reasonably solid footing. Still, the disruptions from Omicron cannot be ruled out, as cases soar every passing day. Will the new wave hold up the Fed from its aggressive stance to focus again on growth? If you found this post interesting, do 'Like' and 'Share' it, and 'Follow' us here to access more of such exciting content. You can also write to us at beat@sganalytics.com.

Jan 13, 2022

Last Wednesday, the European Commission proposed a highly divisive policy, calling for the energy derived from natural gas and nuclear to be labeled as “sustainable” investments if they meet certain criteria.

While admitting that the proposal was not perfect, EU Financial Services Commissioner, Mairead McGuinness, claimed it struck a balance between differing opinions. The move has subjected the European Commission to criticism, with environmental groups and climate activists accusing the EU of “greenwashing." They claim that labeling natural gas and nuclear as green energy would slow down the adoption of renewable energy. But proponents supporting the move counter that such incentives would aid underdeveloped countries to transition from coal to cleaner alternatives. The decision, however, is not final. The European Parliament and council of heads have four months to consider the proposal. Could the move hurt The Union's credibility? Was the proposal well-thought-out for an entity as influential as the EU, a beacon of climate action? Could it really accelerate the world's transition to a low-carbon future? What do you think? If you found this post interesting, do 'Like' and 'Share' it, and 'Follow' us here to access more of such exciting content. You can also write to us at beat@sganalytics.com. Content contributor: Vijay Nitin Suvarna

Jan 13, 2022

Following the Federal Reserve’s latest monetary policy meeting in January, the Fed is set to embark on its rate hike cycle with the first hike coming as soon as March to tame stubbornly high inflation. Concerns about an impending rate hike sparked volatility across assets classes, including US high-yield bonds. However, if history is a guide, US high yield performed well in the rising interest rate environment. The ICE BofA US high yield index outperformed with an average return of 16.2% during the Fed rate hike cycles since 1994 and delivered positive returns in 4 out of those 5 instances with the exception in 1999-2001, which coincided with the dot-com bubble burst. That said, the economic background behind the rate hike cycle this time around looks different. The US inflation rate is nearly at a 40-year high of 7%, while the unemployment rate of 3.9% is just shy of the Fed's goal of maximum employment than the previous rate-hike cycles. These factors could cause the Fed to get even more aggressive. Moreover, the Fed has doubled the pace at which it is scaling back bond purchases, putting it on track to conclude the program by March 2022. It has also hinted at shrinking its balance sheet post hiking rates, with market participants expecting it to start in June 2022. Nevertheless, the corporate balance sheets had improved substantially in 2021 to weather the aftermath of monetary tightening. Most of the companies are in the recovery or expansion phases of the credit cycle. Additionally, the high-yield index has near-zero exposure to the technology sector (highly sensitive to change in real interest rate) and short duration (around 5 years), making them stand pat against the rate hikes. If you found this post interesting, do 'Like' and 'Share' it, and 'Follow' us here to access more of such exciting content. You can also write to us at beat@sganalytics.com. Content Contributors: Rakesh Kakani Nidhi Gupta

Good things come in small packages! SGA Beat comprises insights-fuelled short stories on the hottest industry trends and topics, based on the latest information straight off our latest research endeavors. Beat is packaged in bite-sized, short-form nuggets and presented to you as quick reads – enriched with facts and insights that are easy to absorb and assimilate. Catch-up on the latest buzz around, one refreshing read at a time!

The Himalayas, one of the most beautiful yet fragile ecosystems in the world, is a source of water for billions of people living in South and Southeast Asia.

China is the largest refiner of the world’s lithium and currently the biggest investor in lithium mines around the globe. Chinese scientists recently discovered ‘super-large’ deposits of lithium near Mount Everest, that could potentially produce a million tons of lithium oxide, a key element in batteries powering electric vehicles.

While this discovery could provide raw material to accelerate the fast-growing Electric Vehicles (EV) and battery storage market, prospects of mining the newly found lithium deposits would be an energy- and water-intensive operation, leading to adverse environmental impacts, and raising severe concerns over the fate of freshwater resources in the Himalayas.