BUSINESS SITUATION

- The client, a leading private equity firm regularly encountered a high volume of companies seeking fundraising opportunities. Financial models submitted in the pre-screening phase for analysis required manual processing to generate comprehensive financial summaries

- This manual approach often led to inconsistencies and posed challenges in maintaining the firm's branding standards

ENGAGEMENT

- We developed a system that efficiently extracts key financial parameters from the financial model into a concise standardized format capturing all relevant ratios and KPIs

- Our solution facilitates rapid and focused analysis of extensive documents.

SGA APPROACH

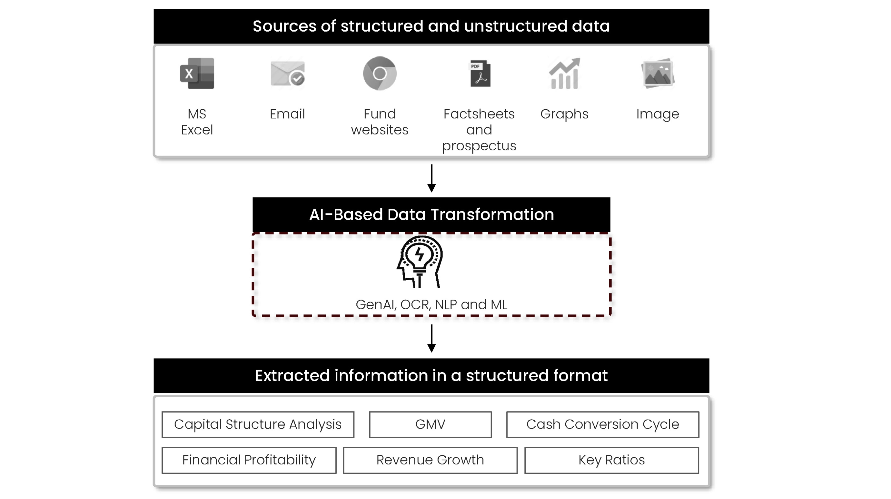

- Designed a solution using four models: GenAI, OCR, NLP and ML

- Textual Data Extraction: Retrieve information from databases, documents, and graphs.

- Image Data Processing: Extract data from visual media.

- Data Organization: Efficient data structuring and storage

- Advanced Data Analysis: Employ programming languages for complex data

- Data is presented in a standardized format using clients’ branding guidelines, for quick and effective decision making

- Tool to give a preliminary assessment based on the defined criteria

Data extraction using GenAI for automating financial summary creation for faster and more consistent deal evaluation

Click on the image to view enlarged

BENEFITS & OUTCOME

- Saved approx. 80% of the processing time

- Ensured uniform presentation of financial data across all evaluations

- Offers quick, informed decisions with preliminary assessments based on defined criteria

KEY TAKEAWAYS

- Automates the time-consuming process of data extraction, processing, and analysis, significantly reducing the time required to generate financial summaries

- Ensures high accuracy in data extraction and analysis, minimizing human errors and maintaining consistent evaluation standards across all assessments