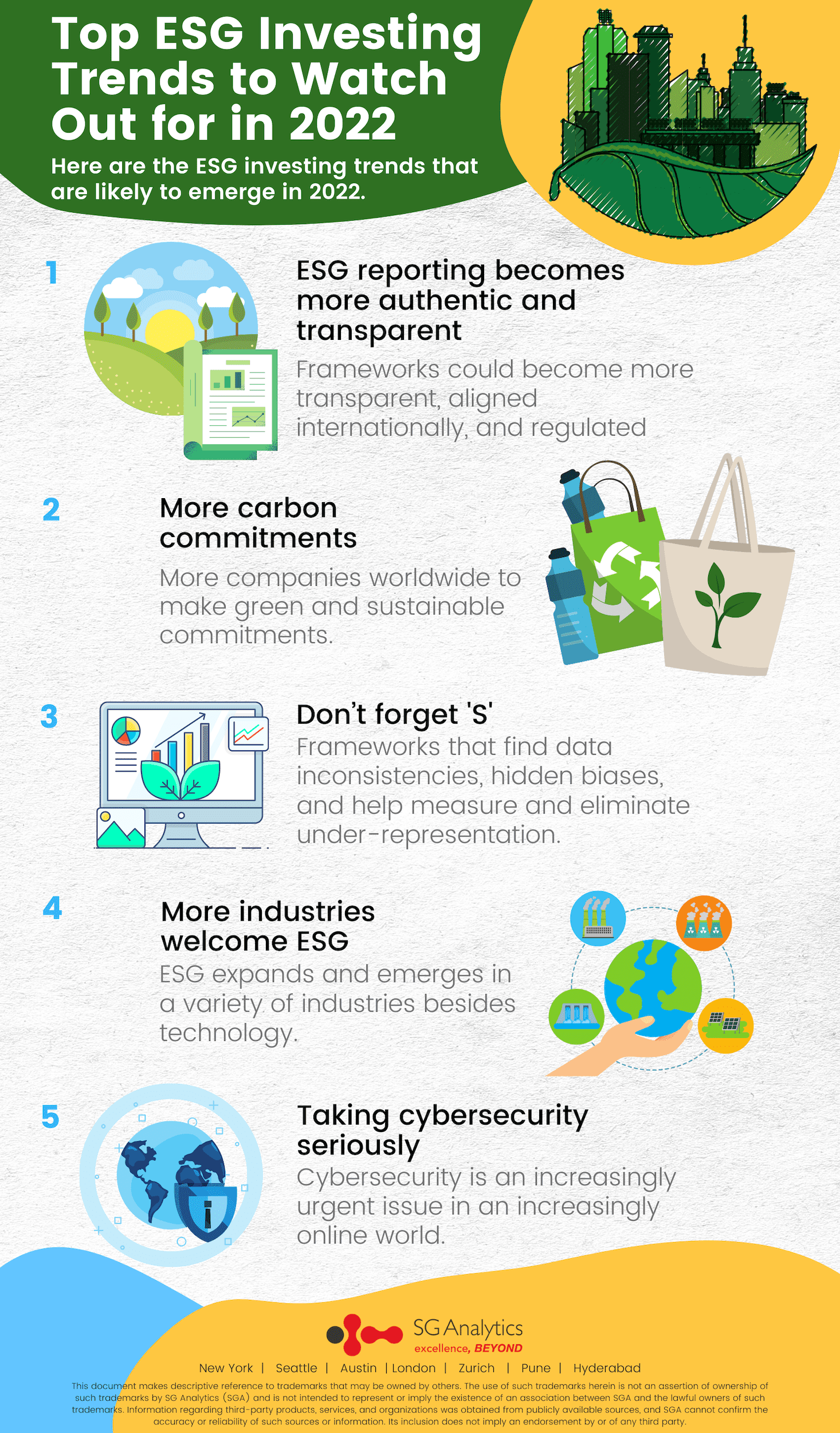

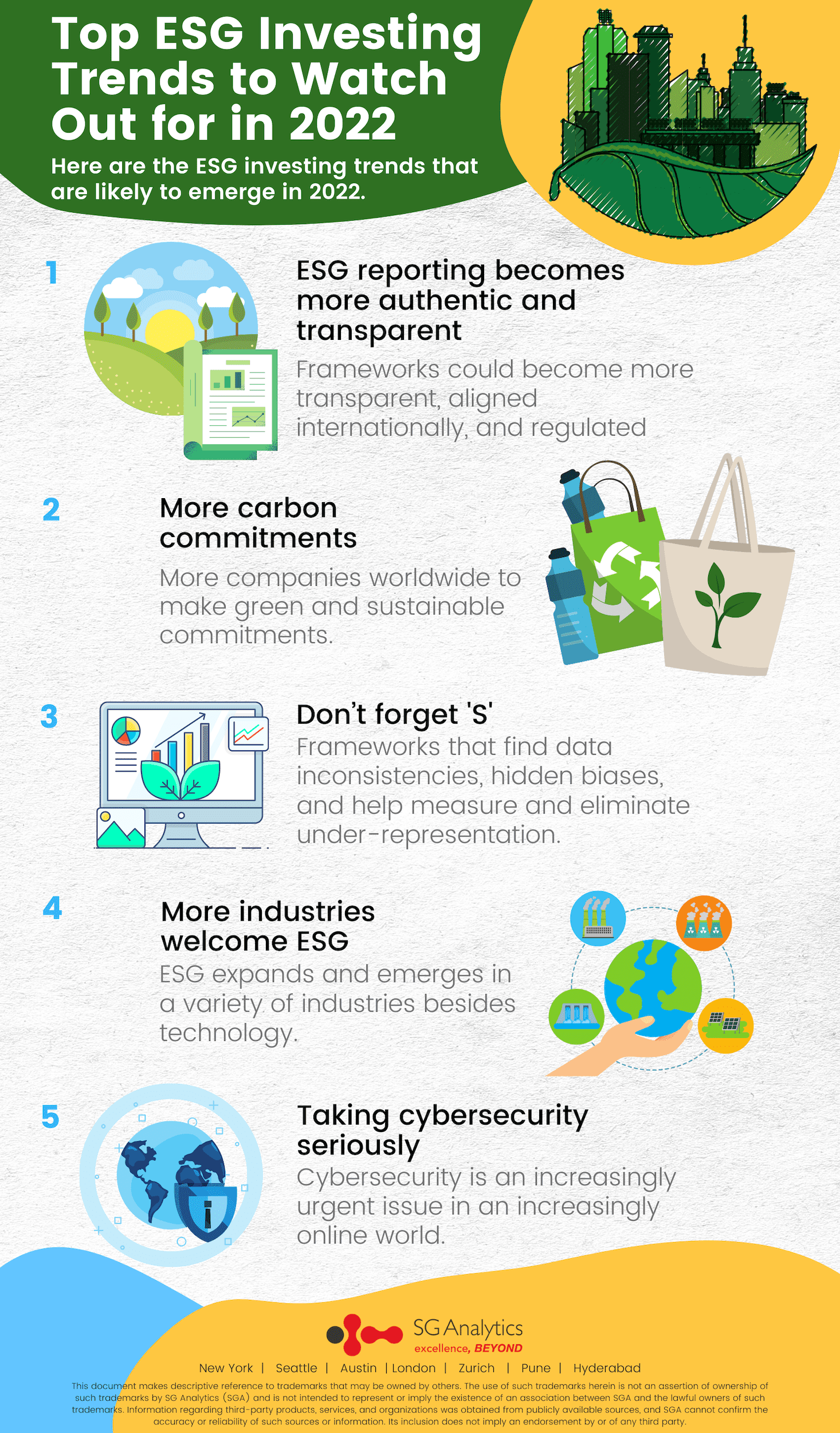

1. ESG reporting becomes more authentic and transparent

It is great to see corporations take responsibility for their actions and make the world cleaner, more diverse, inclusive, and ethical. There is just one problem: it is unclear how clean, diverse, inclusive, and ethical they are making it.

If ESG performance and stock price are correlated, it is in the best interest of a company to engage in ESG reporting. Besides companies disclosing their ESG data themselves, their ESG performance is also reported by data analytics and market research agencies, who may assign every company an ESG score. Every agency may have its own framework to assess ESG performance and determine a score. And that is precisely the issue.

Today, there exist hundreds of agencies that together have produced thousands of ESG ratings. Who is to say which one is accurate? The industry lacks strict guidelines on how to determine a company’s ESG score. And the lack of standardization leads to disagreement and confusion. Worse, it instead encourages companies to not prioritize ESG.

The lack of standardization discourages innovation in ESG because the innovation may go unrewarded. What if you, as a business owner, adopt an ESG practice, but it never reflects in your ESG rating? In fact, since most frameworks are closed, ‘black boxes,’ you may not even find out why your ESG rating did not increase. And since your ESG rating remains unchanged, it is likely that so will your valuation.

On the other hand, companies can exploit the confusion to gain a higher rating, and therefore, valuation. That is called greenwashing. It is either achieved by making lofty—but vague—claims that create hype. Or by self-labeling an entire fund or initiative ‘green’ even though it is only partially green. For example, a company may label itself environmentally friendly because it recycles. However, it could conveniently conceal the emissions produced by manufacturing and shipping. When a company says it is green, it should be green throughout the supply chain.

Read more: “Greenwashing” Is Misleading ESG Investors – Understanding the Gray Areas

But all that is about to change. Standardization is on a steady rise. The EU’s Sustainable Finance Disclosure Regulation (SFDR) stipulates that investment firms clearly disclose activities that negatively affect biodiversity. SFDR has not established metrics, but it is a good start, nonetheless. Singapore’s Monetary Authority has issued guidelines on environmental risk management. Regulators in India, a major emitter of greenhouse gases, have proposed a framework for disclosing ESG investments in mutual funds that could come into force by October 2022.

Greenwashing is ESG’s greatest foe. And in 2022, we could finally fight back. Frameworks could become more transparent, aligned internationally, and regulated.

2. More carbon commitments

The United States and European Union have pledged to become carbon-neutral by 2050. What does that mean? It means that the two will offset the carbon they produce by planting trees, capturing and storing carbon, and simply using renewable energy instead of non-renewable energy.

However, recently, China and India, too, joined the initiative. China has pledged to become carbon-neutral by 2060, while India has committed to carbon neutrality by 2070. That is outstanding news because China and India, along with the US, represent the world’s biggest emitters of greenhouse gases.

In 2022, we expect to see innovations that will help the countries fulfill their commitments. Giants such as Google, Microsoft, and Apple are already miles ahead, making full use of their ample resources to become carbon-free by 2035. However, as renewable energy becomes cheaper and scalable, smaller companies should follow. Chinese and Indian companies are expected to follow an identical trend, making breakthroughs in battery storage and optimization tech.

In 2022, especially considering COP26, we expect more companies worldwide to make green and sustainable commitments.

Read more: “Net-Zero by 2070”: #COP26 Climate Deal, Here Are the 5 Biggest Talking Points

And hopefully, follow through.

3. Don’t forget ‘S’

The ‘E’ in ESG has been the go-to for companies since it is the easiest to define and measure. When Apple, Google, Microsoft, or an entire nation commits to becoming carbon-free by a certain year, the target is well-defined, and progress is easy to track. Compare the target to becoming inequality-free by 2050. The problem is harder to define (‘what inequality’) and even harder to track (‘how do we measure discrimination’).

But we must solve the problem—especially today when so many key decisions are made with the help of technology. And so much technology is unregulated, using which we, knowingly or unknowingly, promote discrimination.

But we must solve the problem—especially today when so many key decisions are made with the help of technology. And so much technology is unregulated, using which we, knowingly or unknowingly, promote discrimination.

Take COVID-19, for example. The pandemic exposed and further widened long-standing inequalities in healthcare, education, and technology, among other domains. Its brunt was borne by whom?

Given a choice, not men but women were more likely to quit their job to support their families since they were paid less. Doing so minimized the family’s financial hit. Minorities and low-income communities were more likely to get the infection. At the same time, they were also less likely to get the vaccine.

There are several other examples. Take hiring and law enforcement. Today, both rely on AI to some extent for decision-making. The problem is, the data the AI relies on is historical, reflecting decades-old systemic biases.

When Amazon deployed such an AI to identify and screen candidates for technical roles, it discovered that the AI discriminated against women. For a variety of socioeconomic reasons, the tech industry has been dominated by white men. Amazon’s AI looked at the data and inferred that men are superior to women when it comes to technical know-how. Remember that such a decision could make-or-break someone’s life. Amazon tried to refine the AI but soon gave up and abandoned the project.

Read more: Bias in AI: How Recruiting With AI Reduces Costs…and Diversity

In 2022, we could see the emergence of frameworks that aim to validate datasets and the technologies and algorithms that rely on them. Such a framework would find inconsistencies, hidden biases, and help measure and eliminate under-representation.

4. More industries welcome ESG

The overwhelming majority of ESG funds comprise investments in technology. As explained, investors turn to technology because progress in the sector is much easier to define and measure.

However, in 2022, investors can expect to see ESG expand and emerge in a variety of industries. That is great news because it is a win-win for both sustainability and investors.

The movement will bring an all-around positive change in the market. When different industries adopt ESG principles, the market will finally be able to address the concerns of different stakeholders. Whereas, for investors, the expansion presents an opportunity for diversification.

The movement will bring an all-around positive change in the market. When different industries adopt ESG principles, the market will finally be able to address the concerns of different stakeholders. Whereas, for investors, the expansion presents an opportunity for diversification.

Healthcare is a fitting example. The world certainly does not want to see a repeat of 2020. That is why countries are now forming pacts to translate short-term mitigation initiatives into long-term strategies for preventing and managing future pandemics. One strategy demands that nations share genomic and contagion-related data openly and transparently. Another demands that high-income countries support low-income ones by supplying medical aid and vaccines.

Read more: “COVID’s Starkest Lesson”: Global Data Is Broken. Here’s How to Fix It

The COVID-19 pandemic also saw a steep rise in anxiety and other mental conditions. And the healthcare industry is now pushing the hardest it ever has to highlight the importance of mental health, especially for low-income communities who have less access to care. In 2022, both physical and mental health care can no longer be a privilege. The sector has to become more inclusive.

And that is just healthcare. At SG Analytics itself, we provide ESG consulting to businesses that belong to a range of industries, from finance, mining, energy, IT, and insurance to software, pharma, biotech, and hospitality.

5. Taking cybersecurity seriously

So many industries have gone digital in the last decade. As a result, we do so much online. We get in touch with family and friends, shop for groceries and gifts, book tickets, and even bank online.

In doing so, we generate vast amounts of data. Over 80 billion gigabytes every year, according to estimates. Much of that data is private and sensitive: messages exchanged with friends or family, transaction data, and bank information. It is imperative that the data remain private and not fall into the hands of malicious agents.

And that is not the only data that needs protection. While identity theft and phishing are the most common forms of cybercrime, companies also want to protect themselves against intellectual theft: patents, designs, future projects, business strategy, and so forth.

In 2021, financial theft and intellectual property damage led to over 6 trillion USD losses. As more and more companies become cloud-enabled, the figure is expected to climb to 10 trillion USD by 2025. What does ESG have to do with it? Well, companies that deploy such systems have a responsibility to make them secure—to protect your (and their) sensitive data. Since cybersecurity is an increasingly urgent issue in an increasingly online world, companies that fulfill this responsibility are likely to be valued higher.

Read more: Top AI Trends in 2022

Therefore, industries that store and process consumer data—that is, most industries—will invest heavily in infrastructure and software to improve user authentication and validation. Investors will regard companies that do so across the supply chain as more resilient. We also expect to see more regulation and the emergence and bolstering of policies like the EU’s General Data Protection Regulation (GDPR).

With offices in New York, Austin, Seattle, London, Zurich, Pune, and Hyderabad, SG Analytics is a leading research and analytics company that provides tailor-made insights to enterprises worldwide. If you are looking to make critical data-driven decisions, decisions that enable accelerated growth and breakthrough performance, contact us today.

But we must solve the problem—especially today when so many key decisions are made with the help of technology. And so much technology is unregulated, using which we, knowingly or unknowingly, promote discrimination.

But we must solve the problem—especially today when so many key decisions are made with the help of technology. And so much technology is unregulated, using which we, knowingly or unknowingly, promote discrimination.  The movement will bring an all-around positive change in the market. When different industries adopt ESG principles, the market will finally be able to address the concerns of different stakeholders. Whereas, for investors, the expansion presents an opportunity for diversification.

The movement will bring an all-around positive change in the market. When different industries adopt ESG principles, the market will finally be able to address the concerns of different stakeholders. Whereas, for investors, the expansion presents an opportunity for diversification.