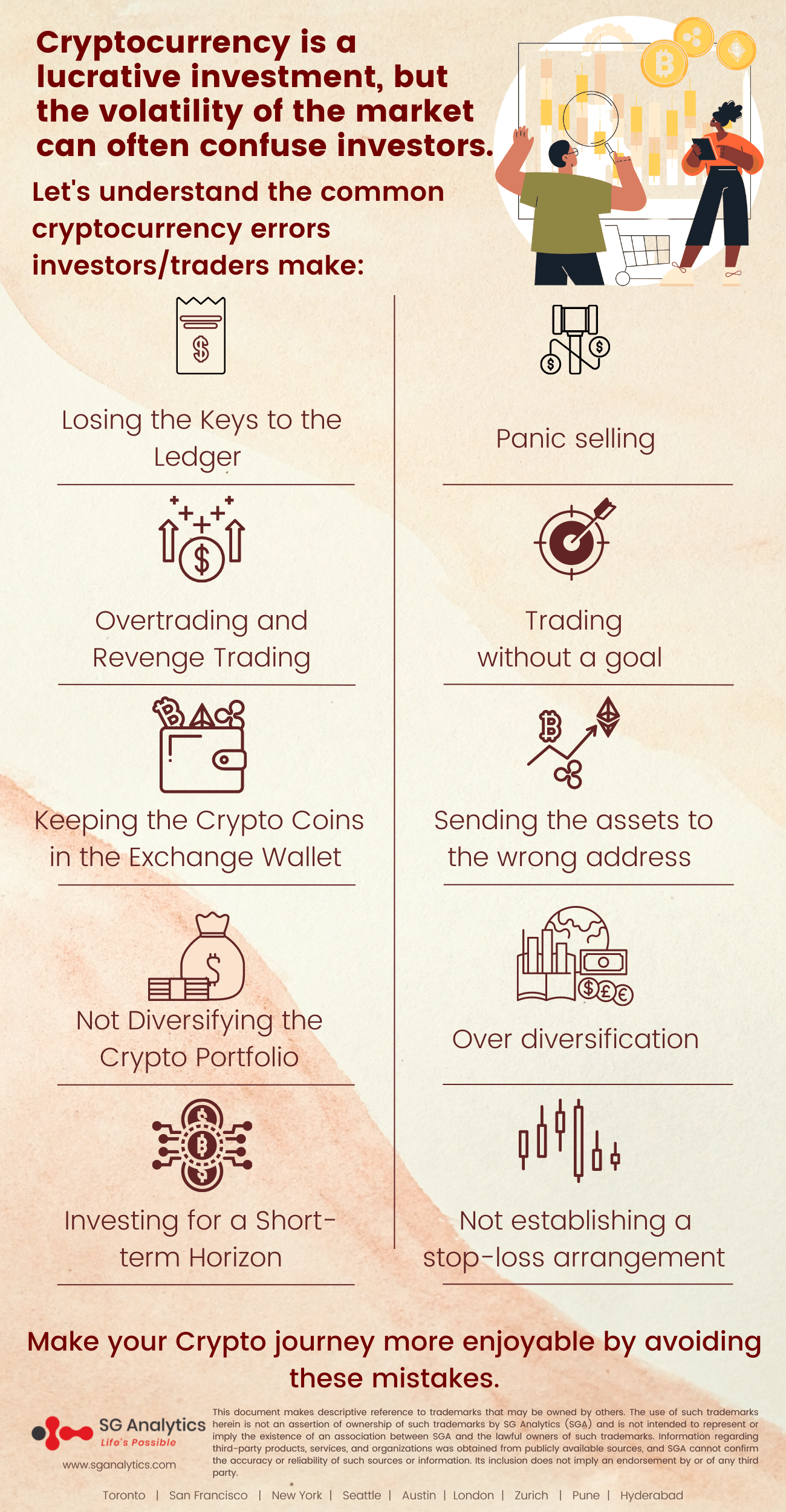

Everyone today wants a piece of the cryptocurrency pie. While cryptocurrency is a lucrative investment, it has its own risks. Many are often overwhelmed by their profits, thus wanting to make more. But this could direct them to make some common cryptocurrency trading errors that could translate into huge losses, thus leading them to not invest again.

The Expanding Crypto Ecosystem

The rapid price movements of cryptocurrencies such as Bitcoin, Ether, and Ripple are fueling headlines across the globe. These blockchain-powered digital currencies are creating a money revolution with their price volatility.

The cryptocurrency landscape is segmented based on the capitalization of many cryptocurrencies. Cryptocurrencies are designed to operate in a decentralized manner. This indicates that while they are an innovative avenue for global value transfers, there is no guarantee for the security of the assets.

Crypto trading is no longer reserved for the affluent. Investing in cryptocurrencies and digital assets is now easier than before. The introduction of multiple trading platforms has enabled investors to jump right into the investment and trading market.

Read more: “Speed, Data…Crypto?”: Fintech Trends to Watch Out for in 2022

Online brokers and centralized & decentralized exchanges provide investors the flexibility to buy and sell their digital tokens. As a result, many investors and traders make major investing mistakes due to a lack of proficiency and experience. Here are a few mistakes investors should consider and avoid to not go broke.

-

Losing the Keys to the Ledger

Cryptocurrencies are built on blockchain technology. A distributed ledger technology, blockchain provides high levels of security for digital assets without the requirement for a centralized custodian. However, this puts the responsibility of protecting the digital assets on the holders. Storing the cryptographic keys to the digital wallet is an integral part. Digital transactions on the blockchain are created using private keys, which act as a unique identifier to restrict unauthorized access to the wallet.

Unlike a password or PIN, the user cannot reset or recover the keys. This makes it highly crucial to keep the keys safe and secure, as losing them would mean losing access to all digital assets in that wallet.

-

Panic selling

Many investors invest in Bitcoin or other cryptocurrencies on a particular day and then find the market crashing the next day. This is one of the biggest mistakes when entering the crypto market. As investors, it is vital to have a clear intention of what you want to gain from the investments rather than selling the crypto out of mere FOMO (Fear of Missing Out).

Cryptocurrencies are known for their volatile price history. A small market crash does not signify that the entire investment will be lost in one go. Holding onto the cryptos is a necessary investment tactic traders should adopt while investing their money in Bitcoin and other cryptocurrencies.

-

Overtrading and Revenge Trading

Investors may be drawn to trade their cryptos multiple times in a day to generate more profit. This can lead to unnecessary losses, causing investors to change their minds. It can also increase tax liabilities. Many investors resort to Revenge Trading after incurring losses from overtrading. Revenge trading is done to make up for the lost profits. Most often, this can lead to more losses. Here are some tricks to avoid falling into this trap:

- Set a maximum loss limit for a day or week

- After a losing trade, sit out for a specified time

- Employ stop-loss arrangement

- After losing, take a few days off from investing and start afresh.

-

Trading without a goal

It is vital to understand the motive behind trading in cryptocurrency. Is it because it is in vogue or because you see it as a potential source of investment? While the motive of the purpose can be debated, it is vital to have a goal in mind before entering the crypto trading landscape. A goal-less trading strategy plan will often lead you on the path to tremendous losses.

-

Keeping the Crypto Coins in the Exchange Wallet

As traders, it is always preferable to store the coins in the exchange wallets instead of moving them to a non-custodial or hardware wallet to save the coins' costs. However, this is not a good practice. As a beginner, when the investments are in an exchange, there is a high chance that they might get wiped out with just one click. The disadvantage of storing the coins in an exchange wallet is that the user does not entirely have control over their holdings. The exchanges hold the funds, which are often vulnerable to fraud. Hence, it is advisable not to keep crypto coins on exchanges.

Read more: What Will the Economy Look Like in 2022? 6 Trends to Watch Out For!

-

Sending the assets to the wrong address

Investors should be cautious while transferring their digital assets to another person or wallet. There is no provision to retrieve the sent digital coins if sent to the wrong address. This mistake often occurs when the sender is not attentive while entering the wallet address. Transactions on the blockchain are irreversible. This kind of mistake can be fatal for the investor as well as his investment portfolio. Hence, crypto holders should be cautious while undertaking digital asset transactions.

-

Not Diversifying the Crypto Portfolio

With tons of cryptocurrencies available in the market, as an investor or trader, it is important to continuously diversify your investments. As a beginner on this crypto journey, it is safe to start with more robust and stable coins. Buying bitcoin as a beginner is the most secure investment option; all cryptos are strongly correlated with bitcoin.

Cryptocurrencies fluctuate constantly. Their prices go up or down depending on the market trends. The crypto investment market follows a pump and dump scheme to attract greedy investors. As a beginner, it is important to be prepared for the market's volatility and aware of such frauds.

-

Over diversification

Diversification is vital for building a resilient cryptocurrency portfolio. Given the high volatility levels in the space, the sheer options available, and the predominant appetite for outsized gains, cryptocurrency investors & traders often end up over-diversifying their investment profiles, which can have enormous consequences.

Over-diversification signifies investors are holding many heavily underperforming assets, leading to considerable losses. It is vital to diversify cryptocurrencies where the fundamental value is clear. It is equally important to understand the diverse types of assets and how they perform in different market conditions.

-

Investing for a Short-term Horizon

Cryptocurrency prices keep on fluctuating. In fact, the prices keep on moving up and down all the time. This makes predicting their values extremely challenging. Traders and investors must also be prepared to deal with price fluctuations and student market dips. Hence, it is advisable to set a long-term goal for the investment based on the price trends and market situations.

-

Not establishing a stop-loss arrangement

A stop-loss is an order type that allows investors to sell a security only when the crypto market reaches a specific price. Investors use this to prevent losing more money than they are willing to, ensuring they at least recover their initial investment.

In many cases, investors often experience huge losses due to an incorrect setup of their stop losses before asset prices drop. However, it is equally crucial to recognize that stop-loss orders aren't perfect and can sometimes fail to trigger sales.

However, the importance of setting up a stop-loss arrangement to protect your investments cannot be understated, as it helps mitigate the losses during the downturn of the market.

Read more: $1.4T Vanishes in Market Cap as Cryptocurrency Prices Plunge. What Gave?

Cryptocurrency markets are volatile enough without these simple and easily avoidable mistakes.

Wrapping up

Crypto investing and trading is a risky affair with no guarantees of success. Yet the crypto investing market is steadily advancing towards gaining popularity. For traders and investors to get used to it, it is important to be aware of the market and its dynamics. Avoiding mistakes while buying cryptocurrencies will help in getting the best out of the investments.

Cryptocurrencies overlap with key areas of the monetary and financial systems. Owing to their rapid growth, complexity, high volatility, and potential for facilitating illicit activities, policymakers across the globe are concerned about their inclusion in the existing system and initiating policies to revise the existing systems to fit them.

Like any other form of trading, the cryptocurrency market demands patience, caution, and understanding. Blockchain places accountability on the investor, so it is critical to take the time to figure out the distinct aspects of the market before putting your capital at risk.

With offices in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Investment Research services, SG Analytics helps leverage custom research support across a broad range of asset classes to enhance their investment decisions. Contact us today if you are looking to navigate the financial markets, enhance your portfolios, and make strategic decisions to achieve your financial goals.