Why customers may dump a telecom operator for a new one

The Indian telecom sector witnessed a rapid transformation and significant rise in competitive pressure in the past few years. Hence an Indian telecom operator needs to offer a competitive value proposition that distinctly differentiates it from its competitors.

SG Analytics (SGA) conducted a survey in Pune to study and understand customers’ feedback on telecom operators. SGA also wanted to ascertain the primary reasons for customers to switch over to a new telecom operator. Using a face-to-face approach, SGA conducted a pen and paper interview with 800 respondents.

Key Takeaways

In conclusion, the survey results suggest that telecom operators can get an edge over competitors by providing:

- Better network connectivity through improved coverage, reduction in call drops and proper network while roaming. Customers identify these factors to be of utmost priority to them. Ultimately, these aspects influence their decision to switch to another telecom operator.

- Furthermore, telecom operators should offer a better value proposition to post-paid users to reduce their churn rate. They should aim for highly differentiated customer experience with a customer-centric approach to keep customers delighted.

- Telecom operators should focus on competitive pricing for calls and data plans across both post-paid and prepaid connections. They should also tailor and design suiting customer experiences for different customers.

- Telecom operators must streamline their marketing channels across age groups (26+) and user types (post-paid) to maximize reach and competitive advantage.

Let’s take a more detailed look at the demographics and results to gain further insights:

Demographics

The demographics were drawn from a random sample cutting across age, gender, employment status, household income and user type.

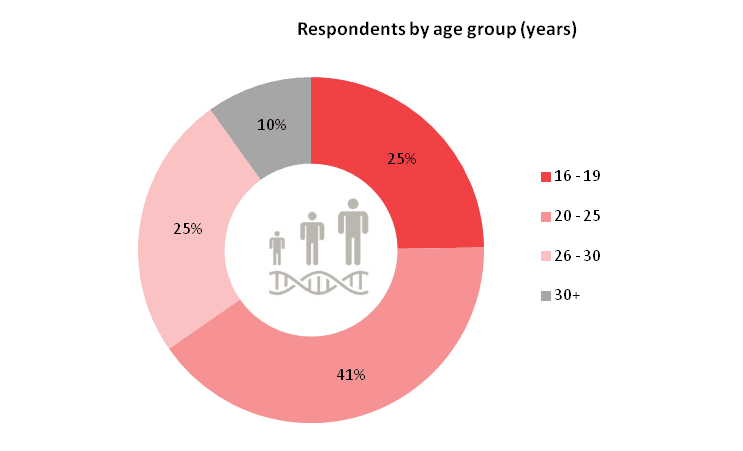

Age & Gender

Below is the breakdown of the age of the interviewees.

- 25% of the respondents were between 16 and 19 years of age

- 41% between 20 and 25 years,

- 25% between 26 and 30 years,

- 10% respondents aged 30 years and above.

In all, 56% of the respondents were males while 44% were females.

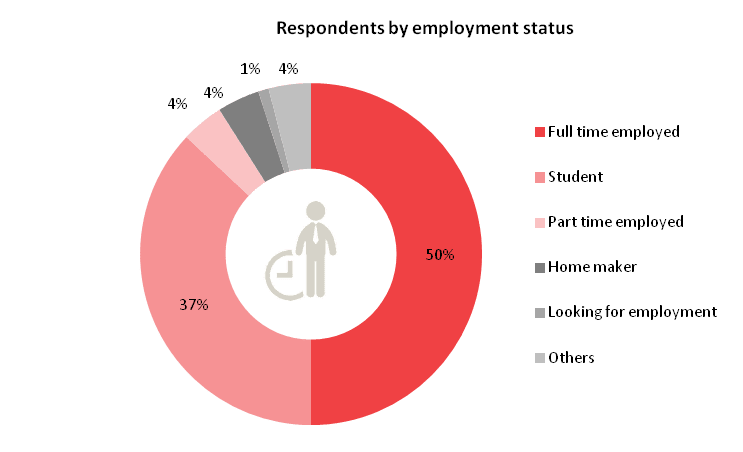

Employment status

Below is the breakdown of the respondents’ professions.

- 50% of respondents said they work full-time,

- 4% respondents worked part-time,

- 4% respondents were homemakers,

- 1% respondents were seeking employment,

- 37% respondents were students and

- another 4% respondents were engaged in other activities.

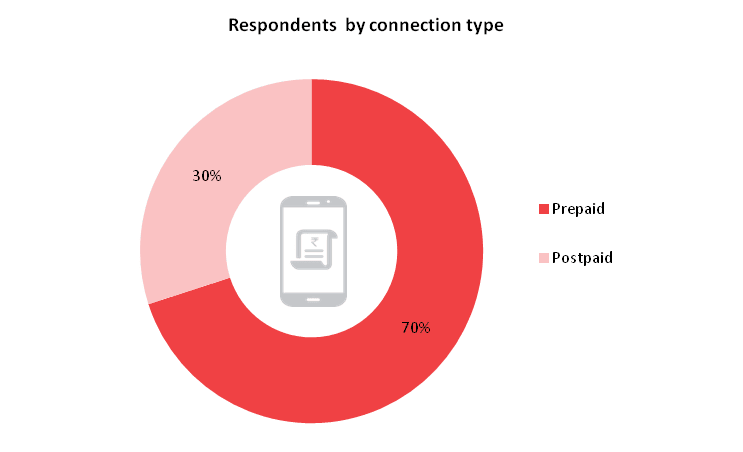

Connection type

In all, 70% of the respondents had a prepaid plan, while the remaining 30% used a post-paid service.

Market and Competitor landscape

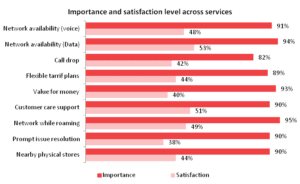

The respondents rated their satisfaction level across several key service parameters, including network availability, pricing, and customer support. Their feedback indicated a very low satisfaction level of customers towards attributes they deemed as the most important pertaining to telecom services.

Over 50% of the overall respondents indicated that they were unhappy with their present telecom operator. The dissatisfaction is particularly higher with post-paid customers.

Opportunities

Respondents expressed better network connectivity as the overarching factor influencing their decision to switch over to another telecom operator. More than two-thirds of the respondents and 80% of post-paid customers said they would change the service provider if they got better network connectivity.