Investors are directing their focus on exploring opportunities beyond ESG considerations to sustain a positive transformation through impact investing. Impact investors are linking the pursuit of risk-adjusted returns with positive real-world outcomes. Impact investing is expected to offer a chance to make a real difference to Sustainable Development Goals (SDGs), thereby opening a new growth opportunity investment universe.

What is Impact Investing?

Impact investments are incorporated with the goal of generating positive and measurable environmental impact with a positive financial return. Impact investments can be incorporated in emerging as well as developed markets. It helps achieve a target range of returns from market-to-market rate based on strategic goals. With an impact lens, investors can identify opportunities often overlooked when following a sustainability-themed approach.

The growing impact investment market is targeted to offer positive capital returns as well as address the most pressing challenges in sustainable investment, renewable energy as well as basic accessible services like housing and healthcare. Impact investment is more than just a differentiator for a new investment product. It is giving rise to the enduring transformation that is expected to shift the very fabric of the global economy, thereby paving the way for a more stable and equitable economy.

Impact investing as a sector has been growing significantly over the span of the last few years. 2024 is expected to further intensify the growth of impact investment due to the venture of more mainstream investors in the market along with explosive growth in climate finance.

Read more: Creating Value for Climate Change Crisis Through the Lens of Private Equity

.jpg)

Sustainable Finance Impact Investment Trends

-

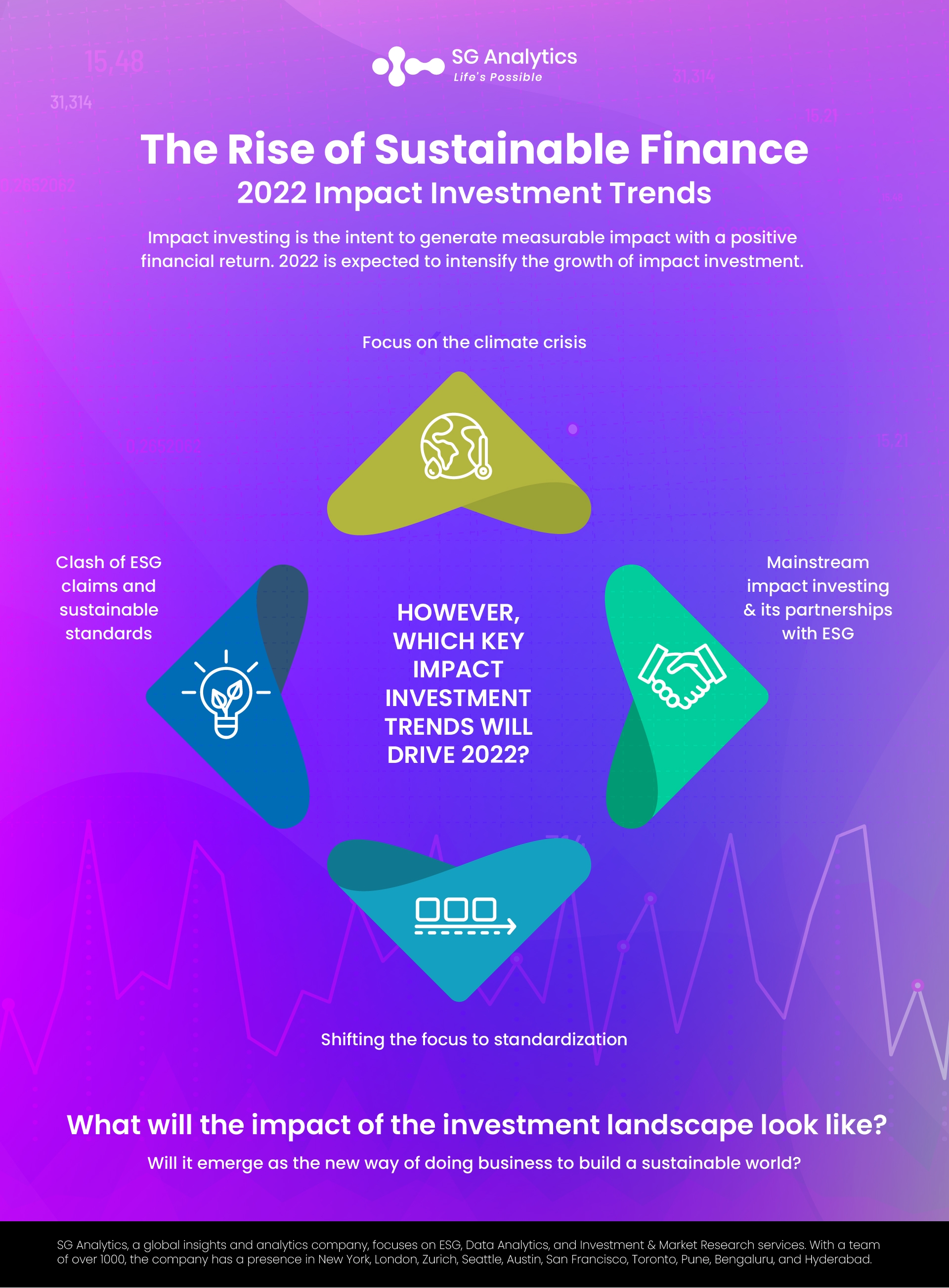

Focus on the Climate Crisis

The major focus in 2024, so far, has been on tackling environmental crises and climate change. With COP26, the initiative has started receiving momentum and has grown into a climate finance-related movement, both in the financial and corporate world. However, as per the UN report, to protect the earth’s ecosystems and repair the existing damage, a total of USD 700 billion a year in extra funding from governments and businesses will be required over the next decade.

Investors should now focus less on companies with heavy carbon-emitting industries, as they are likely to face the increasing risk of stranded assets as well as the changing resource landscape, new government regulations, and fading interest of consumers. Corporations across all sectors are facing requests from investors for financially relevant ESG data connected to their scope 1, 2, and 3 emissions. This data enables investors to better assess the company’s true exposure to a climate crisis and global warming.

While the ESG momentum generated around COP26 indicates a good start, there is still a risk that the rising popularity of funding climate projects will soak out other sectors that are equally important. Major institutional investors are renewing their interest in impact investing as an initiative to drive climate considerations and ultimately achieve net-zero ambitions.

.jpg)

-

Clash of ESG Claims and Sustainable Standards

Sustainable and impact investing is attracting record fund flows but relatively small subsets over the traditional investment industry. So, what’s holding investors back?

A recent survey by CFA Institute found that 62% of respondents highlighted awareness around greenwashing along with the need to establish a more succinct definition of sustainable investments. There is a rising need for more clarity on how impact investments accommodate fiduciary duty. In the year 2024, businesses are likely to gain clearer guidance and regulations in this space.

In March 2021, the SEC or Securities and Exchange Commission launched its Climate and ESG Task Force, a step towards designing disclosure and language that constitutes sustainable strategies. It is named to mandate organizations for data disclosures related to climate change and human capital. SEC also stated the intent to mandate businesses to disclose their ESG information foreshadows in order to surge the climate change and human capital datasets, thereby setting more targeted investment portfolios.

Read more: Biggest BFSI Trends to Watch out

-

Shifting the Focus to Standardization

With the number of investors in impact investment growing, the chances of impact washing, along with the need for a common language to combat the risk, are also on the rise. Organizations are making progress toward the standardization of impact management to measure and report culminating outcomes. The long-term significance of impact investing is continuing to advance towards mandatory disclosures of impact on corporations.

Owing to the positive outlook on the influx of new players in impact investing, 2024 will experience more investors jumping into this domain of investing for good. Industries will foresee huge growth in impact investing and fewer queries on positive returns. While the focus is still on the return on investment, there is an underlying shift that is aimed at what the impact investment is accomplishing on the ground level.

-

Mainstream Impact Investing & its Partnerships with ESG

While impact investing in the past was perceived as a niche market, investors are now witnessing a landslide happening as private bankers and asset managers are now focusing on how to incorporate things jointly to generate net positive investments.

Mainstreaming impact investing was the integral theme of the G7 Impact Taskforce. There is an increasing focus on the mobilization of private sector capital through composite finance and co-investment strategies with multilateral development. The finance industry transitioning to net-zero is perceiving impact investing as a supporting pillar for growth.

Banks and other development finance institutions are now addressing the risk/return constraints and observing initiatives aimed at involving institutional investors through the listed markets. The partnerships between ESG and impact investing are also cropping up in other domains of the market.

From acquisition and fund management firms to private equity and venture capital enterprises, businesses are turning their attention to impact as new emerging products in fintech are enabling individuals to build their own impact investment portfolios. This increase in corporate impact also signifies better organizational engagement as well as control over climate commitments.

In conclusion, impact investing is going mainstream, thereby setting up the next major trends vital for measurement and disclosure.

Read more: Inflation Hits a New High in the US. Where is the Economy Heading?

What Will the Future of Impact Investing look like?

As per the Global Impact Investing Network, the size of the impact investment market is nearly US$502b. And it has doubled since last year, which is likely to grow.

The market is expected to continue to build focus on the climate crisis as a global challenge to overcome. With investors becoming vocal about sustainable investment, the momentum behind impact investing is likely to grow while shifting into new directions. There is an increasing focus on broader economic and ESG impacts, including job creation, health and educational outcomes, along with access to finance and skills training.

Previously investments we more focused on traditional methods, but with impact investing, the theme is now changing. Businesses, as well as investors, are aligning their active portfolios with sustainable investments. With the growing wealth, impact investing will continue to grow as part of the investing landscape.

Key Takeaways - Impact Investing

-

As per the research published by the World Economic Forum, impact investing is an approach aimed at creating both financial return and positive social and environmental impact that can be actively measured.

-

The impact investing industry is continuing to scale as the influence of affording investors is increasing on public and private markets in 2024.

-

The industry will be on the cusp of larger adoption in 2024 and beyond as new regulations and guidance seek to clarify and standardize the industry.

-

Measurement remains one of the hardest parts of the industry.

-

The most pronounced investor opportunity will be expected to be in climate change, an area having significant implications for investment portfolios.

-

In 2024 impact investment themes will offer an elevated opportunity for investors to reimagine the future.

Read more: What is ESG Investing

To Sum Up - Impact Investing Trends

Impact investment is gearing up to build and create a quantifiable impact on societal and financial returns. Data channels around climate change and the future of work will lead to the creation of new thematic investment strategies. New regulatory guidance on impact investing standards will empower investor perceptions of greenwashing and mismatch with fiduciary duty. It is also enabling organizations to position ESG for greater adoption to fight the climate crisis.

By incorporating enhanced tools, investors are seeking impact investment to catalyze their climate innovation and build more resilient and inclusive companies. Businesses are now incorporating strategies to demonstrate both positive profit and purpose. And the impact investing trend is only set to rise.

In 2024, the impact investing trend will continue to drive and scale sustainable investment, thus scaling businesses on the path to reimagining the future of investing.

But what will the impact of the investment landscape look like? And will it emerge as the new way of doing business to build a sustainable world?

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in Investment Research Services, SG Analytics assists in strengthening investment decisions by leveraging custom research support. Contact us today if you are in search of an investment research firm that offers tailored research support across a broad range of asset classes.