ESG or environmental, social, and governance investing has steadily made its way to becoming an investment strategy that enables investors to put their money in companies that are working to make the world a better place. ESG investing requires balancing the environmental, social, and governance factors along with financial factors in the investment decision-making process. Investors are incorporating these non-financial factors as part of their analysis process to identify risks and growth opportunities.

Today, several countries are increasingly making the ESG disclosures mandatory for organizations in their annual report or in standalone sustainability reports. Several ESG-conscious companies are opting to make ESG disclosures available to the public.

Read more: Driving Sustainable Innovations: AI for ESG Data Challenges

With the challenges related to climate change increasing, the global market is experiencing a push for sustainable policies. Globally 85% of institutional investors are driving interest in ESG. Studies are predicting that by 2025 one-third of the total global investors and asset holders will consider ESG for direction.

In developed markets like Europe and others, ESG has been around for some time. From the Indian perspective, the trend has started sprouting over the last couple of years. The first ESG fund was launched in 2018. Currently, 17 mutual funds based on ESG are in the Indian market. Big asset management companies like Aditya Birla Sunlife, ICICI Prudential Fund, Axis Equity Fund, Kotak Fund, Invesco India Fund, MIRAE Asset Fund, SBI Magnum, and others offer specific schemes based on ESG.

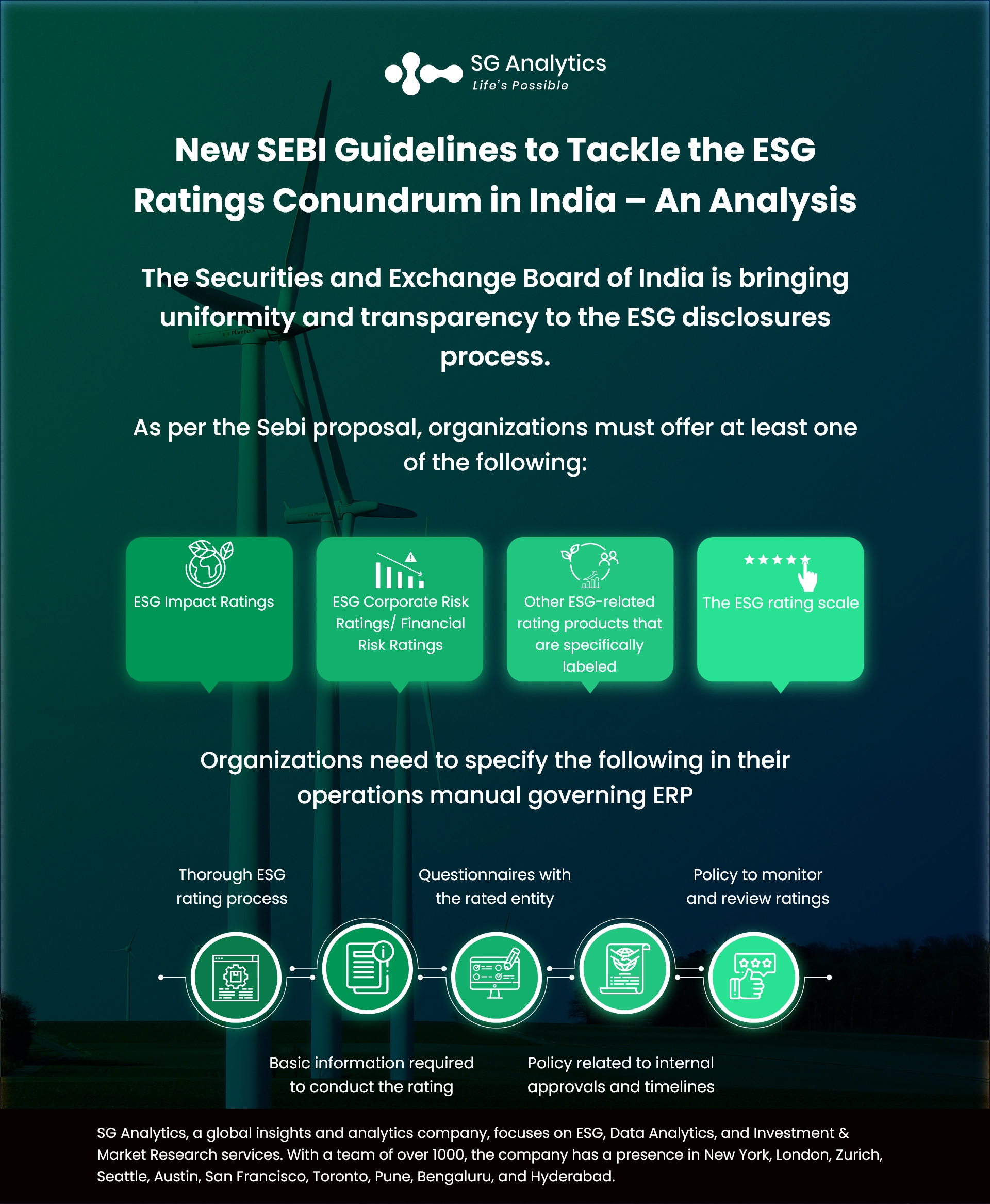

SEBI, or Securities and Exchange Board of India, has taken the right steps to bring uniformity and transparency to the entire process. This will enable investors to understand the value of their investment from the ESG standards perspective. The Indian capital market has proposed tighter environmental, social, and governance (ESG) rules as it is moving forward on the path to minimizing the risk of greenwashing and misuse of ESG ratings by companies.

Charting Ahead

The Securities and Exchange Board of India released a consultation paper that sought to regulate ESG rating providers, mandate disclosures and drive the listed organizations, registered funds, and index providers to use the accredited ESG raters. In the report, they have also proposed a subscriber-pay model that contrasts with the one employed by traditional credit-rating firms, where the issuer of the bond pays a fee.

ESG rating is highly unregulated and has no uniform methodologies for agencies for the ratings. The crisis of the existing ESG rating system has led to situations that threaten the real purpose of rating. The purpose of the ESG rating is to offer the right signal and understanding of the organization's contribution to the environment to all stakeholders.

According to the Sebi proposal, credit rating companies and research analysts having a minimum net worth of 100 million rupees will be eligible to apply for accreditation. However, they must offer at least one of the following:

-

ESG Impact Ratings

-

ESG Corporate Risk Ratings/ Financial Risk Ratings

-

Other ESG-related rating products that are specifically labeled

-

The ESG rating scale

Sebi or the Securities and Exchange Board of India proposed that the ERPs shall disclose their rating reports along with the methodology employed to arrive at the same. The data used by these ERPs are proprietary information that the rating providers were previously reluctant to disclose. The framework proposed by Sebi works in accordance with the credit rating agencies to evaluate their debt situation. The proposal is expected to impact the internal processes of some of the large global funds. The proposed rules are expected to have several unintended consequences.

The Rising Demand for ESG Investing

The climate change crisis and sustainable development concerns have become a priority at global levels. For firms that are just starting their ESG journey or scaling up their offerings, they need to:

-

Fulfill client requirements by providing data, tools, and training.

-

Differentiate themselves from their competition and carve a scalable position in the ESG market.

The increase in the interest of investors and financial regulators in examining Environmental, Social, and Governance (ESG) related issues has led organizations into troubled waters. One of the regulators at the forefront of ESG, The Securities and Exchange Board of India (SEBI), has mandated the top 1,000 listed companies to report the Business Responsibility and Sustainability Report (BRSR).

Read more: Trends that are Empowering the ESG Revolution in 2022

The ESG Rating Process (ERP)

The ESG rating process formulated in Sebi's proposal follows a proper rating process to ensure consistency in the application of its methodology across ESG ratings assigned. The ERP offers reasonable and adequate grounds to perform rating evaluations with the assistance of in-depth rating research. It also aids in maintaining records to support decisions. The following components are to be specified by organizations in their operations manual or Internal documents governing ERP-

-

Thorough ESG rating process

-

Basic information required to conduct the rating exercise

-

Questionnaires with the rated entity

-

Policy related to internal approvals and timelines for each step of the rating exercise

-

Policy to monitor and review ratings, including the timelines for the review

Incorporation of ESG Rating Process (ERP) into Investment

ESG has been an emerging trend in the Indian capital market for the past couple of years. The rise in the number of retail investors and increasing demand for sustainable finance has driven organizations to employ environmental, social, and governance (ESG) risks and assess opportunities for investments.

.jpg)

Aligned with this global trend, the Securities and Exchange Board of India (SEBI) has come up with suggestions to regulate ESG Rating Providers (ERPs). The Indian market regulator is employing a framework to regulate ERPs for securities markets. It also incorporates guidelines for ERP infrastructure, transparency, rating process, and prevention of conflict of interest.

In the report, SEBI indicates that all listed companies should employ accredited ERPs if they require ESG ranking. These ERPs must be accredited by SEBI only. Other companies (beyond the listed 1,000) should make public disclosure according to BRSR or Business Responsibility and Sustainability Reporting. These ERPs offer several products. The SEBI throws light on the lack of clarity on ESG rating. For the ESG rating process, SEBI has suggested measures to incorporate the ERP policies and procedures.

The other three elements highlighted in the SEBI report are transparency, the ESG rating process, and conflict of interest. To ensure transparency in ratings, it has asked organizations to display their rating reports and products on their website.

It also asks for declaring the rating methodology. The ERPs are expected to clarify how the environmental, social, and governance components of the ratings are defined.

Regarding standardization of symbols and scales for ESG rating, the SEBI report draws parallels with credit rating agencies in India. It has suggested a framework for rating companies to disclose all the details, including symbols and definitions they are incorporating. Further, these rating methodologies should be reviewed and periodically updated.

Read more: ESG & Sustainability: Top ESG Challenges for Companies to Tackle in 2022

The Way Forward

The ongoing COVID-19 pandemic, along with the climate change crisis, is underlining the vulnerability of traditional business models. There is a need for organizational stability. It also emphasized the role of investors, as they take into consideration the risks and factors while making investment decisions. This leads to increased awareness of ESG reporting and ratings.

A plethora of activities are being employed to inform citizens about the importance of investors and asset managers in the Indian market, catering to domestic as well as foreign investors. Now, when asset managers serve foreign investors, they must integrate ESG factors. Today, the evolution around ESG is the culmination of both- the risk factors impact the financial health of a company as well as the profits.

There is an increasing demand from investors for evaluation and ratings of ESG-related components. By offering more clarity around these aspects, investors, as well as organizations, would be motivated to disclose more granular details of their ESG performance. This will assist in building more robust credentials and attract more investments.

To ensure the commitments to the Paris Agreement and the United Nations Sustainable Development Goals, India is now contemplating incorporating ESG as a key priority.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.