Market watchers have become incredibly curious about the changing world order, with major economies experiencing the inevitable recession. In this blog, we assess the current macroeconomic condition of the U.S., Europe, and China and its effects on the global financial markets.

The U.S. is the largest economy in the world, along with being an important contributor to the world’s GDP. Any major change in the U.S. economy could have a domino effect on the world order. Hence, we start with the U.S. economy and answer some of the most pressing questions about it.

Read more: Adopting Leading ESG Practices can enhance Corporate Value. How?

Will the U.S. economy undergo a soft landing or a hard landing?

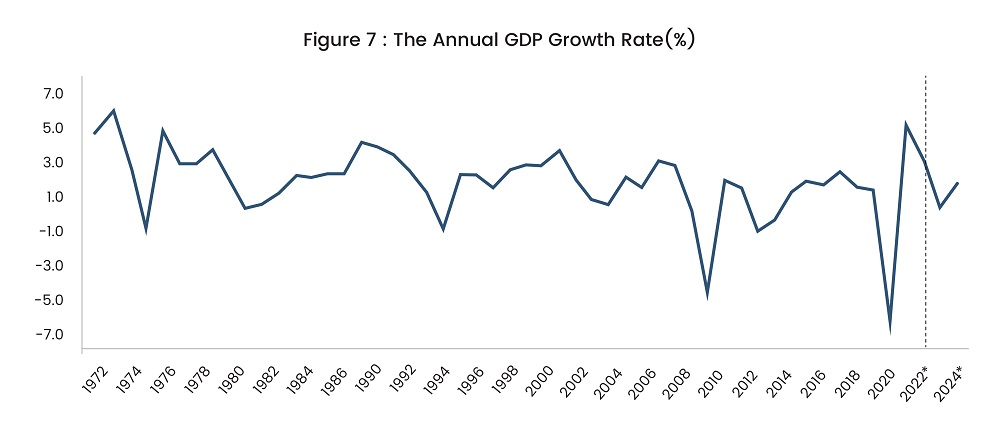

Investors track several leading indicators to assess the economic situation; one such indication is the spread between the 10-yr and 2-yr yield curve, which is usually a positive indicator that will turn negative preceding a recession. In Figure 1, this spread turned negative between 2006-07. Subsequently, the U.S. economy underwent a recession in 2008. Similarly, the yield curve inverted in July 2022 and has been negative, pointing toward a recession ahead.

Source: Federal Reserve Bank of St. Louis (FRED)

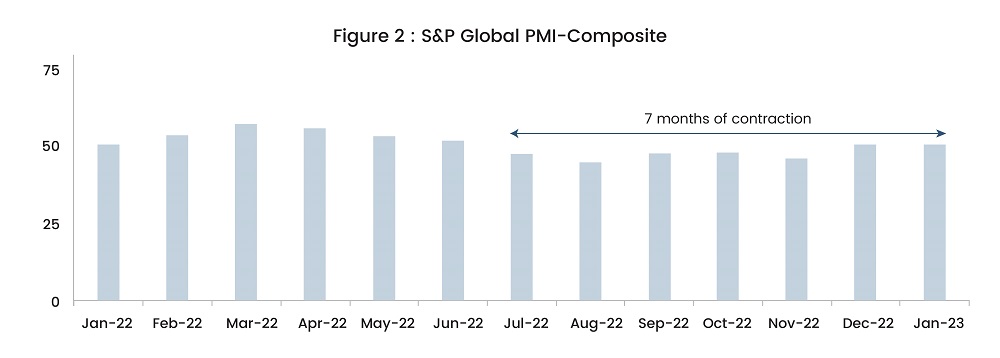

Another leading indicator, S&P PMI-Composite (Figure 2) has been in the contractionary mode (below 50) since July 2022 as well, thereby pointing toward the weakened manufacturing and services sector.

Source: Trading Economics

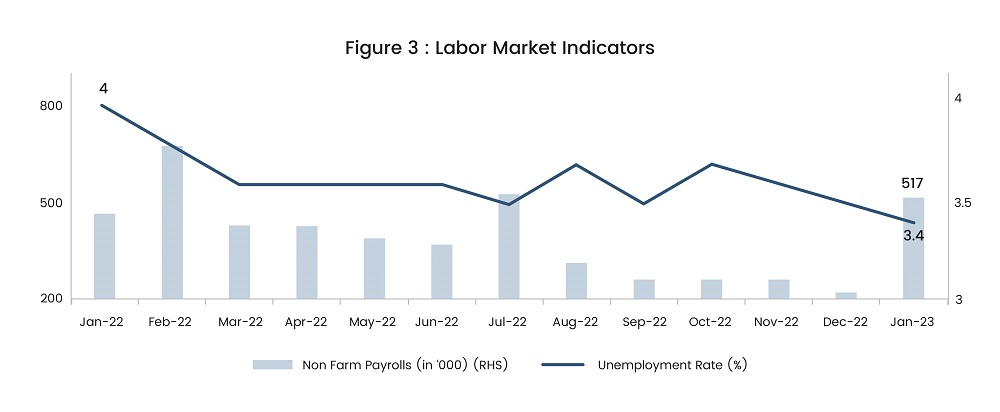

On the contrary, the GDP growth posted de-growth for two consecutive quarters (1Q22 and 2Q22), while the latest print for 4Q22 rebounded to 2.9%, growing for two consecutive quarters now. Additionally, strength in the labour market continues as non-farm payrolls stand at 517k, i.e., almost double the last print, and the unemployment rate stands at 3.4%, the lowest since 1969, which continues to put pressure on the wage and, hence the price levels. Other economic indicators like vehicle sales and retail sales point toward a resilient economy despite the headwinds. To sum up, indicators have been pointing to contradicting outlooks, but a soft landing seems a likely scenario going ahead.

Source: Trading Economics

Will Fed pivot or not?

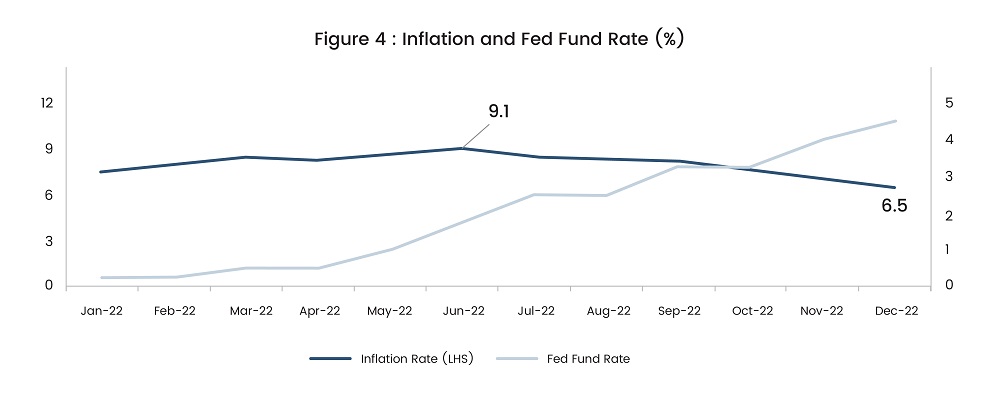

Inflation was a buzzword in 2022, the most discussed topic on any news channel, during earnings calls, and in analysts’ reports. In Figure 4, after rising steadily, inflation peaked at 9.1% in June 2022 and since then has decelerated to 6.5% in December 2022. Even the core PCE, the Fed’s preferred gauge of inflation, cooled down in December. Subsequently, to keep inflation in check, the Fed undertook the most aggressive policy action, raising the interest rates by 425 bps. However, the intensity of the rate hike is expected to come off in future meetings. However, the tight labour market conditions prevail, making it unlikely that inflation will revert to the 2% target set by Fed in 2023. Thus, the Fed expects the rate to be over 5% and remain there throughout 2023. Hence, the Fed pivot seems unlikely in 2023, while a pause in rate hikes is not a far-fetched reality.

Source: Trading Economics

How is the market going to react?

As market participants wonder about the U.S. growth, inflation, and the Fed’s monetary policy trajectory, we have laid out three scenarios and their impact on the market below.

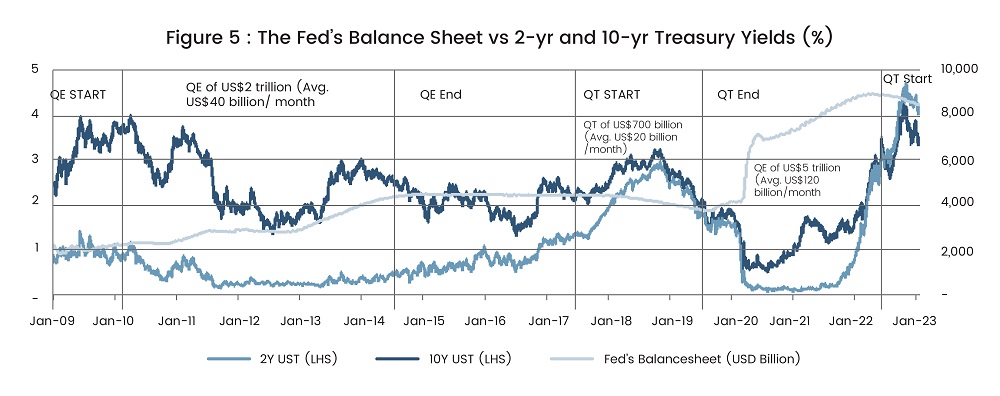

Scenario 1: Slight recession and easing inflation: If the U.S. economy experiences a slight recession, the Fed could halt its Balance Sheet reduction and keep the policy rate steady. This should result in the spread difference between 2-yr and 10-yr bonds narrowing to zero. Meanwhile, the S&P index should remain sideways.

Scenario 2: Economic growth and inflation: If the U.S. economy continues to show signs of resilience, the Fed could continue reducing its Balance Sheet and hiking interest rates albeit at a slower pace. In such a scenario, the 10-yr and 2-yr bond yields should widen with the slope of the yield curve turning positive. Additionally, the S&P500 index could also continue to trend lower.

Scenario 3: Strong recession and inflation – Stagflation: If the U.S. economy experiences a strong recession, the Fed needs to rescue the economy through Balance Sheet expansion and interest rate reduction. This should result in both 2-yr and 10-yr bond yields falling, and the yield curve remains inverted. Against this backdrop, the S&P index could rebound and trade above 4,500 levels.

Source: Federal Reserve Bank of St. Louis (FRED)

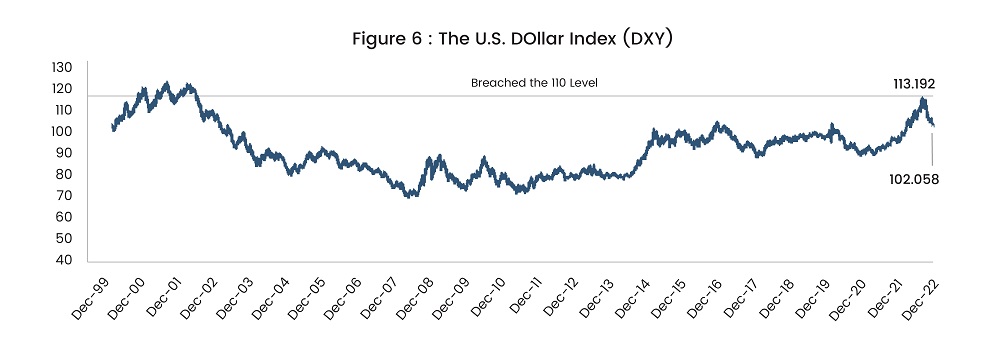

What path would the dollar follow?

The Dollar index breached the psychological level of 110 last year, previously seen in the early 2000s, though now it has cooled off by 10% from the high that was observed and continues to cool off. Narrowing interest rate differential could put pressure on the greenback as the Fed halts while other major economies continue to raise rates, thereby bringing down the differential that was enjoyed by the dollar in 2021.

Source: Bloomberg

Europe also plays a vital role on the global economic front. The European economy was battered with constraints that were unprecedented and challenging. We discuss the condition of the economy, inflation, and monetary policy ahead in the sections below.

Will the European economy rebound in 2023?

Despite high energy prices and the global economic slowdown, the European Union (EU) reported a growth rate of 3.6% in 2022. Factors like increasing government expenditure, advanced household consumption, and net external demand, where imports outpaced exports, all had a negative influence on the GDP. However, due to economic headwinds, unprecedented fiscal transfers to households and spending out of excess savings led to large and unusual swings in both income and spending. Contrary to popular belief, consumption growth in 2022 was robust despite the weak real income growth. Even going ahead, the European Central Bank (ECB) expects the GDP to grow by 0.5% in 2023.

Read more: Investing in Energy Stocks: Hottest Green Energy Stocks to Invest in

Source: Bloomberg

Will the ECB achieve its 2% target in 2023?

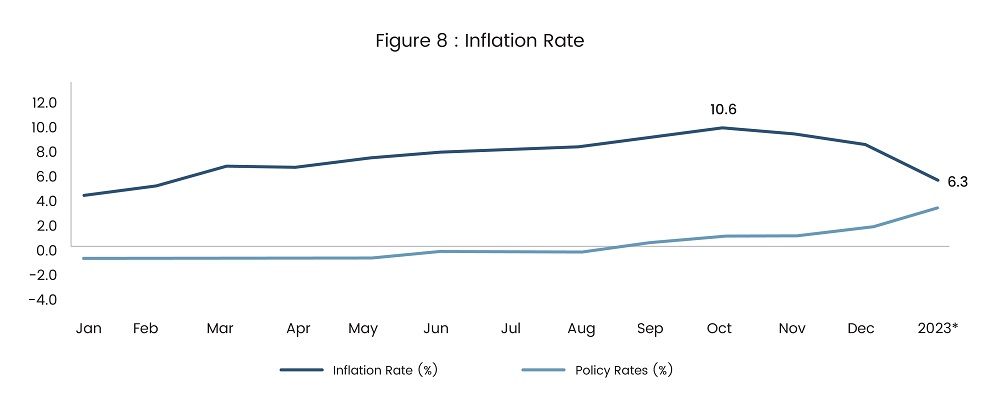

Inflation peaked at 10.6% in October 2022 but eased off to 9.2% in December. The slowdown in the economy, along with the easing of supply constraints and some moderation in food and energy prices, will reduce pricing pressures. However, there are several reasons for inflation to be likely over the ECB’s 2% target this year. Spike in energy prices, high import prices, and a tight labor market increase the risk that higher wage growth will sustain long enough to foster persistent inflation. Thus, the ECB policymakers forecast that inflation will cool down to 7% by the end of 2023 and revert to 2% by 2025. Consequently, the ECB has hiked interest rates by 250 bps since the summer and targets to raise the rates to 4% by the end of 2023. Additionally, the ECB began quantitative tightening in the first half of 2023 by passively winding down its asset purchase program to help reduce market liquidity.

Source: Bloomberg

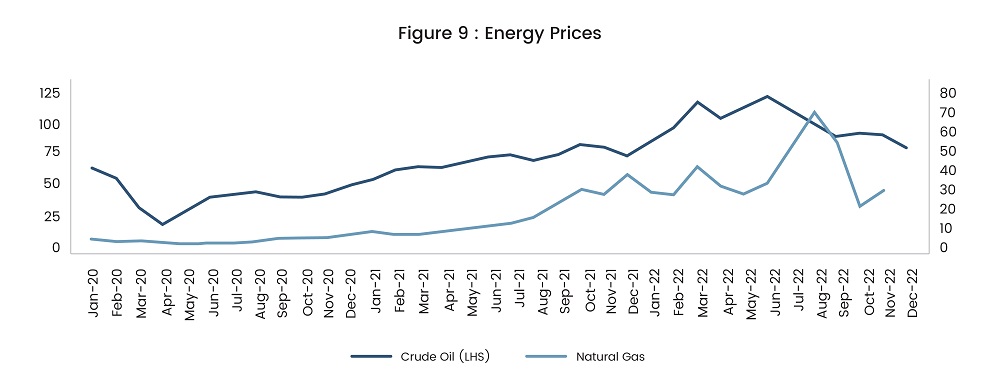

Despite making up only 10.9% of the headline inflation basket, energy has a substantial impact on headline inflation as its costs fluctuate much more than those of other components such as housing. Due to import restrictions on Russian crude oil and supply chain bottlenecks brought on by the Russia-Ukraine war, direct trade from Russia is limited, which has a significant impact on the rising energy costs. Going ahead, energy prices are expected to remain elevated.

Source: Bloomberg

How does the market react to such conditions?

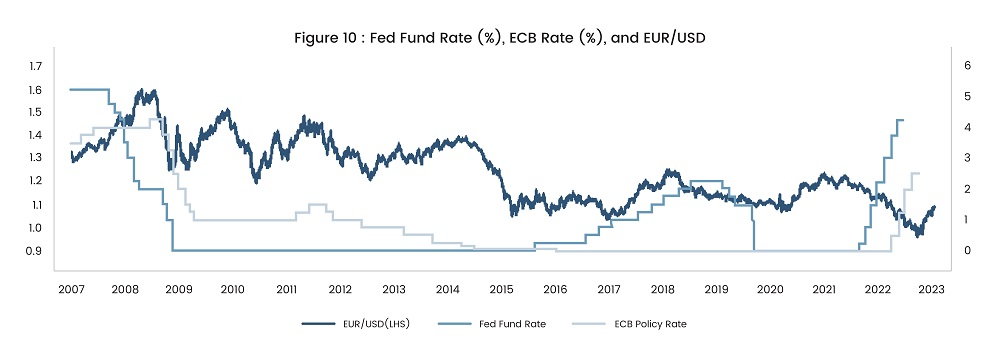

The EUR/USD should benefit as the difference between the Fed Fund Rate and the Policy Rate of the ECB widens. The Fed is expected to lower its policy rates, while the ECB officials are likely to raise the rates in 2023. This should increase the differential in the European bond market and enhance the demand for euro bonds, thereby strengthening the euro.

Source: Bloomberg

Last but not least, we look at the Asian giant, China, the second-largest economy in the world, a major contributor toward the world’s supply chain, and a leader in exports of manufacturing items to the world. While the economy disassociated from where the world was heading in 2022, there are still grey clouds looming over China and certain questions that we intend to ponder in this section.

The first question is, the resurrection of the dragon—How long will it take?

Source: Trading Economics

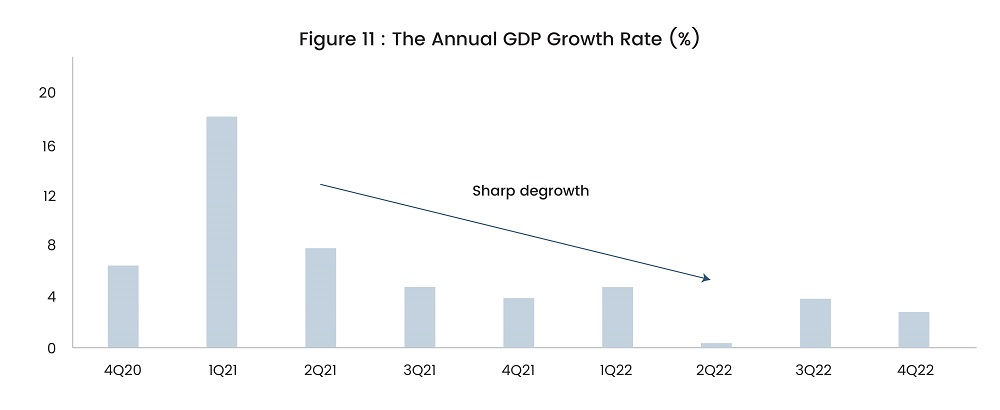

A sharp deceleration in the annual growth rate was observed during 2021–22. It fell to a meager 0.4% in 2Q22, as seen in Figure 11. Supply chains were disrupted, and the shortage of supplies was the common theme, as economies worldwide were scrambling to fulfill the rebounded demand. Stringent COVID-19 policies were the main reason that led to a halt in China’s economic activities. This was exacerbated by the slump seen in the real estate sector, which forms a major part of the Chinese GDP. Though now, we see the economy moderately bouncing back to its feet.

Source: Trading Economics

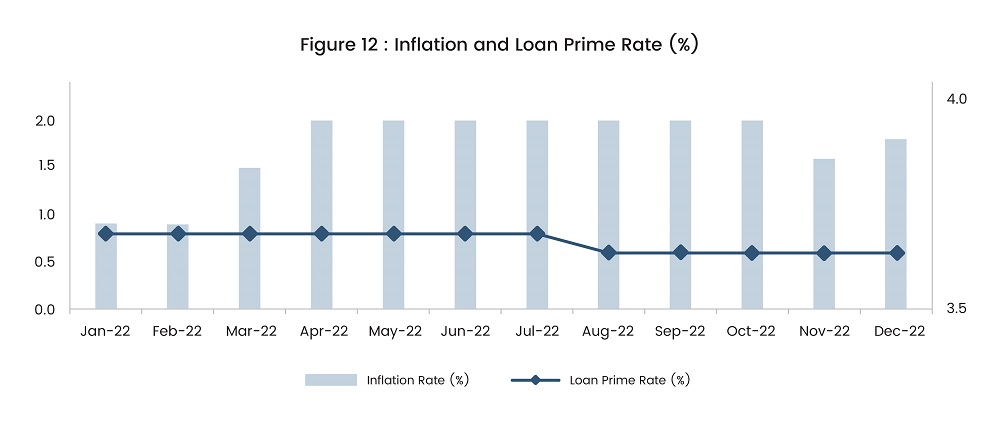

Consequently, subdued economic activity kept the inflation benign and range bound, as well as less volatile, in the last year. Thus, as a direct measure of the People’s Bank of China (PBoC), the loan prime rate was reduced by only 5 bps to 3.65%. However, the PBoC used indirect measures to boost economic activity. The reserve requirement ratio was reduced by 50 bps throughout 2022 and liquidity injections were also undertaken.

Second, is real estate on a better trajectory?

Ever since the major player in the real estate sector came near to default in 2021, it opened a can of worms for this sector, which is a major contributor to the Chinese GDP. The introduction of the Three Red Lines Rule toppled even other major developers in the crisis trap. Hence, the government had to step in and implement measures to support the sector and ultimately boost the economy. One of those measures is the 21-point plan to support developers in delivering good-quality projects in dealing with the crisis. It includes $67bn financing, debt extensions, refinancing negotiations, and support plans for rental housing loans with a common goal to guide property developers navigate through this rough time.

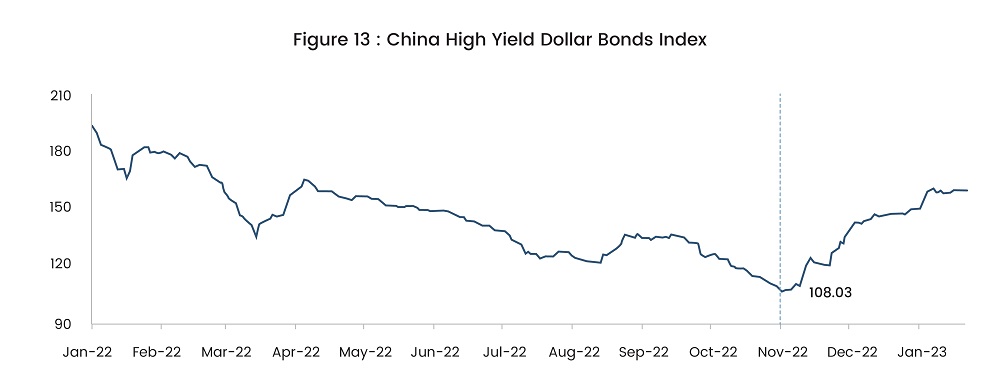

Government measures have had a positive effect on the markets, evident from a sharp rise observed in the high-yield segment index in late 2022 (refer to Figure 13).

Read more: Forecast: Top Venture Capital Market Trends In 2023

Additionally, Wanda properties, a Chinese real estate company, issued its first US$-denominated bonds ($400mn) that received a strong response from the market, as it was oversubscribed 3.7 times. This was after a sharp decline in issuances of offshore bonds in 2022.

Hence, these positive overshoots provide a great boost to the whole Chinese economy, as it does to the business sentiments that are slowly rebuilding and breakthrough China’s high-yield bond market.

Source: Bloomberg

To conclude, these major economies are going through some tough and unusual times. While some of these scenarios are new to these economies but the way they navigate through this would steer the ship of the world economy. Current times would redefine the new and revised order of the world, and as market participants, we can be well-informed about the latest developments and watch as the market evolves.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leading market research company, SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.