With rising interest in Environmental, Social, and Governance (ESG) and impact investing, investors and stakeholders are seeking ways to improve the ESG alignment of their investments to generate positive financial returns. Asset management organizations are now operating to create holistic solutions that are designed to incorporate the positive impacts of ESG and impact investing with risk-return standards of investment. With the changing investment landscape, ESG and impact investing are moving into the mainstream, thus leading to a time where businesses need to rethink how they will incorporate the functionalities in their strategies.

With the rise in popularity of ESG in operations over the years, impact investing has also gained significant prominence globally in the financial and economic sectors. While it boasts positive ramifications, it does eye substantial financial returns.

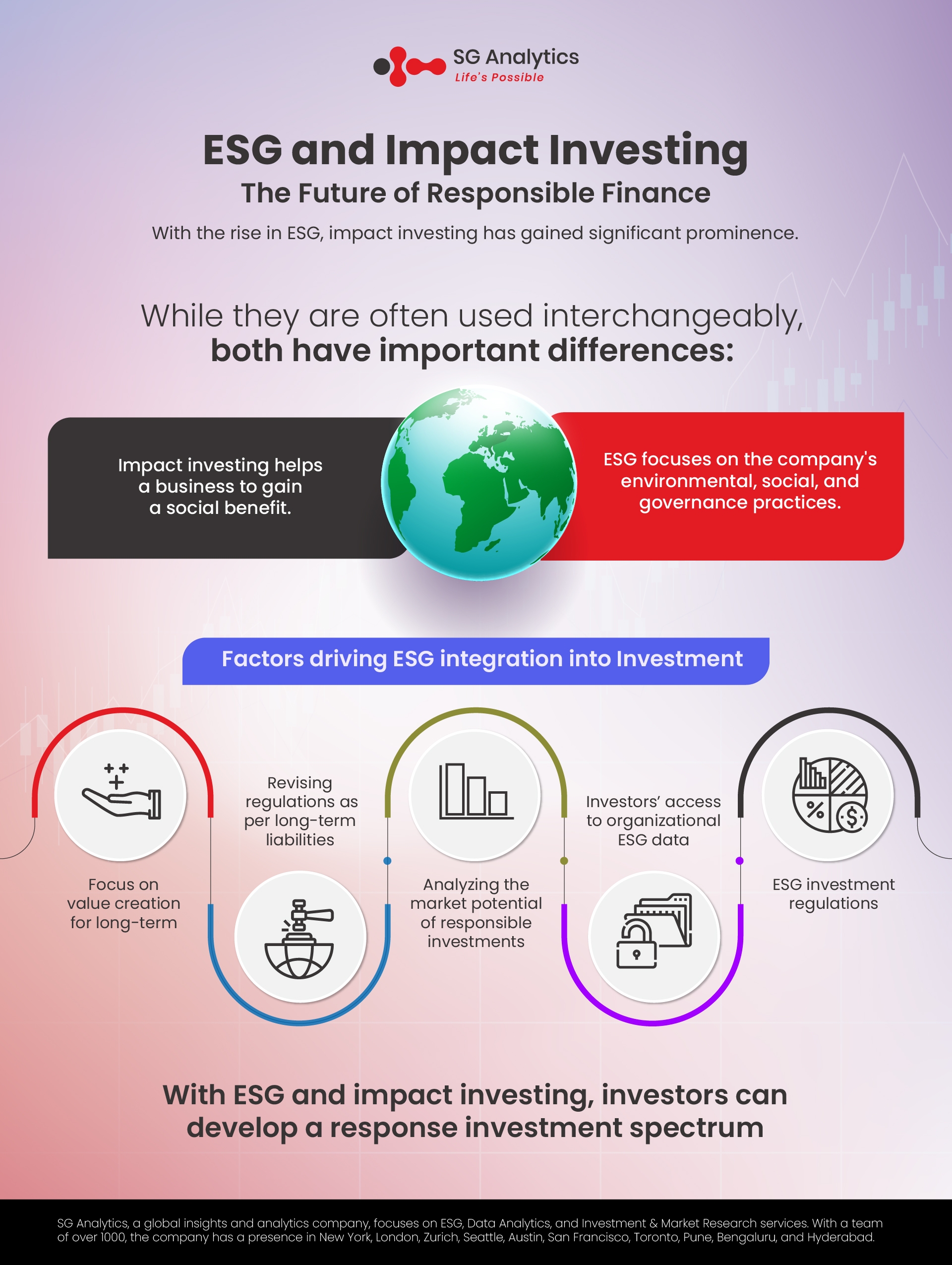

Environmental, social, and governance (ESG) and impact investing are industry terms that are leading the investment landscape towards the dawn of more sustainable finance. Environmental, social, and governance (ESG) and impact investing are often used interchangeably by investors and professionals. However, they have the same approach but subtle differences.

Read more: Integrating ESG in Company Culture – A Move to Drive Resilience

One of the subsets of socially responsible investing, impact investing, is attracting the attention of many. In the U.S., more than one-third of the asset's professional management - as per the survey conducted by the U.S. Forum for Sustainable and Responsible Investment - amounted to more than $17 trillion in assets under management for socially responsible criteria. This growing demand has fueled an accumulation of funds and strategies that incorporate ethical considerations into the investment processes.

Is the Growing Influence of ESG a Truth or Fiction?

.jpg)

Global warming and the ongoing climate crisis have drawn attention to factors like carbon emission, water consumption, and paper use. Regulators are now setting specific norms for businesses to increase ESG integration into their investment processes as well as operations. Institutional investors are now focusing their attention on evaluating the ESG policies of asset management before investing.

Investing today is no longer just about gains or returns. With the rising market trends, a growing number of investors are more focused on utilizing their money to fund enterprises committed to ESG principles as well as to building a better world. With more businesses becoming ESG cognizant, asset managers are incorporating ESG reflections in their business models and strategies.

Exploring beyond the traditional analysis, investors and stakeholders are designing comprehensive ESG integration strategies to analyze the underlying companies. The degree of ESG integration and methodologies differ based on region and asset size or class. This has resulted in significant growth in requests for ESG proposals.

Read more: Less Is More: Embracing the New Trends in Affordability and Sustainability

Impact Investing

In impact investing, positive results are of supreme importance. It is vital for investments to produce a tangible social good. The objective of impact investing is to assist businesses or organizations in achieving precise goals beneficial to society as well as the environment. For an organization, impact investment can be focused on nonprofit funding research in clean energy.

In the Global Impact Investing Network's (GIIN) recent Impact Investor Survey, it is highlighted that the respondents climbed from twenty-four in 2010 to nearly three hundred in the year 2020. The survey also indicated that the impact investing market is worth a considerable US$715 billion.

Today, impact investing is no longer a novel concept. As per the 2022 Sustainable & Impact Investing Review released by Simple, the impact investing landscape is focused on reviewing unique approaches through various case studies. These include direct investments and continued involvement of organizations in innovative projects.

Today, ultra-high net worth individual investors carry tremendous power in the investment landscape due to their exceptional agility.

With ESG integrations, businesses have been able to ethically leverage privately-owned capital investments to transform as well as address significant social and environmental challenges while generating verifiable profits. With ESG and impact investing, investors can develop a responsive and approachable spectrum for their portfolios.

The Rising Impact Investing Revolution

Impact investing can be regarded as the most recent revolutionary development in the evolution of investors. It has helped align the ethical standards of investors with their portfolios. Ever since the emergence of ESG, investors have moved from socially responsible and sustainable investing to integrating environmental, social, and governance (ESG) driven data insights into their investment analysis. This approach incorporates ethical considerations and widens office outlooks outside financial affairs.

What sets impact investing apart from other approaches on the ESG spectrum is its core doctrines. In impact investing, the functionalities revolve around financial and non-financial returns. In comparison, the other approaches are devised to avoid harmful investments. Impact investing aims to decipher situations while generating returns for the organization as well as the investors.

Read more: Trends that are Empowering the ESG Revolution in 2022

ESG as Part of an Impact Investing Process

Investors believe that impact investing is a fringe or an undisciplined practice employed by investment organizations. However, on the contrary, ESG and impact investing are the exact opposites.

Traditional investing and active management are deemed extremely difficult and robust processes, ones that require deep experience and expert teams. In similar terms, ESG and impact investing have their own investing identities. They require similar processes and expertise as traditional investing, along with added rigor and proficiency to understand and embed their true impact to generate positive investment.

Factors driving ESG integration into Investment

The catalysts in the integration of ESG in the asset management industry include the following-

-

Focus on value creation for long-term

-

Revising regulations as per long-term liabilities

-

Analyzing the market potential of responsible investments

-

Investors’ access to organizational ESG data

-

ESG investment regulations

When considering ESG and impact investing, investors should not toss conventional risk or return analysis away; rather, they should work towards maintaining the investment rigor to generate positive profits. Engaging in ESG and impact investing demands a rigorous investment process backed by positive insights.

Key Takeaways

-

The growing number of investors are encouraging businesses to act responsibly to deliver financial returns.

-

ESG or environmental, social, and governance and impact investing is often used interchangeably, but both have important differences.

-

ESG focuses on the company's environmental, social, and governance practices in association with more traditional financial measures.

-

Impact investing enables a business or an organization to gain social benefits.

Read more: Green Finance: The Next Step to Align India's Climate Priorities

In Conclusion

From an investor's perspective, ESG and impact investing are not niche fields or philanthropic experiments. Rather, they are an extension of rigorous traditional investing with a focus on the positive impact on the world. The true scale of the investment sector can only be identified by incorporating the positive impacts of ESG and impact investing with the risks or return standards of investing practices. However, one cannot stray away from the fact that behind these elements, there is business value to be created.

A recent survey reported that approximately 38% of investors believe in allocating their assets in a responsible investment strategy, whereas 66% believed that the recent climate disasters had got them interested in leading about and understanding responsible investing. The passion for investing ethically to gain positive gains is today pronounced among millennials.

Organizations today do not perceive ESG as risk mitigation. In fact, enterprises with strong ESG value propositions are likely to experience higher equity returns and higher credit ratings. Reports state that 81% of the globally representative selection of sustainable elements are outperforming their parent benchmarks.

However, accommodating this desire to do and remain good is not an easy task for organizations. Due to the growing complexity of ESG analysis and the expansion of financial products marketed as socially responsible, businesses are finding it difficult to align their sustainable practices with their traditional, profit-driven strategies.

Today the economy is on the verge of a dramatic shift towards sustainability in all its operations. However, impact investment is being perceived to have a unique ability to sustain as well as drive this shift, thereby bringing a tangible transformation while driving positive returns. And ultra-high-net-worth individuals (UHNWI) investors will be considered the critical foundation with the power to shape the future of sustainable finance.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.